Healthcare AI Citations: How ChatGPT and Google Define Trust Differently

As we head into the new year, we're taking a closer look at critical YMYL categories — starting with Healthcare. When AI answers health questions, accuracy isn't optional. So who does each platform actually trust?

Data Collected

Using BrightEdge AI Catalyst™, we analyzed healthcare citations across ChatGPT, Google AI Mode, and Google AI Overviews over 14 weeks (October 2025 – January 2026) to understand:

- Which source types each platform cites for healthcare queries

- How citation patterns differ by query type (symptoms, definitions, treatments)

- Platform stability and volatility in healthcare citations

- Where Google is experimenting with new content formats like video

Key Finding

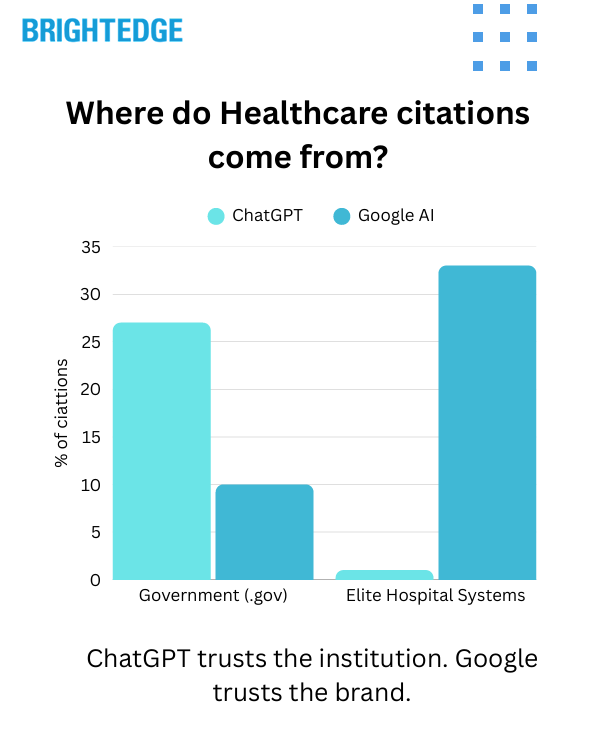

ChatGPT and Google don't agree on what makes a healthcare source authoritative. ChatGPT pulls 27% of its healthcare citations from government sources (.gov) — and just 1% from elite hospital systems. Google AI Overviews flips that entirely: 33% from elite hospital systems, only 10% from government. Same YMYL category, fundamentally different trust signals.

The Trust Gap: Different Platforms, Different Authorities

ChatGPT Trusts the Institution. Google Trusts the Brand.

When we analyzed where healthcare citations actually come from, the platforms diverged sharply:

| Source Type | ChatGPT | Google AI Overviews |

| Government (.gov) | 27% | 10% |

| Elite Hospital Systems | 1% | 33% |

| Medical Specialty Orgs | 17% | 2% |

| Consumer Health Media | 7% | 6% |

ChatGPT leans heavily on government sources like CDC, NIH, and FDA — plus medical specialty organizations (professional associations for cardiology, oncology, orthopedics, etc.).

Google AI Overviews goes all-in on elite hospital systems — major academic medical centers and nationally-ranked health systems.

Neither platform relies heavily on consumer health media (popular health information websites). Both prefer institutional authority — they just define it differently.

The Government vs. Consumer Ratio

How much does each platform prefer official sources over consumer health websites?

- ChatGPT: 4.2:1 ratio (strongly favors official sources)

- Google AI Mode: 1.8:1 ratio

- Google AI Overviews: 2.3:1 ratio

ChatGPT is twice as likely to cite .gov sources over consumer health media compared to Google.

Query Type Matters: Different Questions, Different Sources

Symptom Queries Show the Widest Gap

When users ask about symptoms — arguably the most sensitive healthcare searches — the platforms diverge dramatically:

| Platform | % Citations from Major Hospital Systems |

| ChatGPT | 57% |

| Google AI Mode | 18% |

| Google AI Overviews | 20% |

ChatGPT concentrates trust heavily for symptom queries, pulling nearly 3x more citations from major hospital systems than Google does.

Definition Queries

For "what is" style educational queries:

| Platform | Elite Hospitals | Government | Other |

| ChatGPT | 36% | 15% | 29% |

| Google AI Mode | 12% | 11% | 54% |

| Google AI Overviews | 16% | 12% | 45% |

Treatment Queries

For queries about treatments and procedures:

| Platform | Elite Hospitals | Government | Other |

| ChatGPT | 52% | 8% | 19% |

| Google AI Mode | 17% | 15% | 46% |

| Google AI Overviews | 20% | 11% | 44% |

The Pattern

ChatGPT concentrates citations on fewer, more authoritative sources — especially for sensitive queries like symptoms and treatments. Google distributes citations across a wider mix of sources.

The Volatility Factor: Stability vs. Experimentation

ChatGPT Has Conviction. Google Is Testing.

Beyond source preferences, the platforms differ dramatically in stability:

| Metric | ChatGPT | Google AI Mode | Google AI Overviews |

| Citation Volatility (CV) | 2.1% | 17.1% | 20.2% |

| Week-to-Week Churn | 0.42pp | 2.52pp | 6.94pp |

Google's healthcare citations are 8-10x more volatile than ChatGPT's. What you see in Google AI results today may shift significantly. ChatGPT's citations have remained remarkably stable over our tracking period.

What This Means

ChatGPT appears to have made decisions about healthcare authority and is sticking with them. Google is still actively experimenting — testing different source mixes, adjusting weights, and iterating on what works.

Google's Video Experiment

Where Is Google Testing Video in Healthcare?

One notable difference: Google is experimenting with video content for healthcare answers. ChatGPT isn't citing any video.

- ChatGPT: 0% video citations

- Google AI Overviews: 2.7% video citations

But the volatility tells the real story: video citations in Google AI Overviews swung more than 50 percentage points over just three months (ranging from 22% to 73% of certain result sets). Google hasn't decided whether video belongs in YMYL healthcare content.

Which Query Types Trigger Video?

When Google does cite video for healthcare, it's concentrated in certain query types:

| Query Type | % of Video Citations |

| General Health | 51.5% |

| Symptom Exploration | 21% |

| Condition-Specific | 11.4% |

| Definition/Educational | 5.4% |

| Treatment/Remedies | 5% |

Video shows up most on general health queries — not the most sensitive clinical content. Google appears to be testing carefully, starting with lower-stakes queries before expanding to symptoms and treatments.

Citation Priority: What Users See First

Different Platforms Lead With Different Sources

Beyond which sources get cited, we analyzed which sources appear first (lower rank = higher priority):

ChatGPT Citation Priority:

- Crisis/Support Resources (avg rank 1.7)

- Wikipedia (1.8)

- Medical Specialty Orgs (1.8)

- Elite Hospitals (2.0)

- Government (2.3)

Google AI Overviews Citation Priority:

- Elite Hospitals (avg rank 3.3)

- Wikipedia (3.4)

- Medical Specialty Orgs (4.3)

- Government (5.0)

- Consumer Media (6.3)

ChatGPT puts crisis and support resources first — a deliberate safety choice. Google leads with elite hospital content.

What This Means for Healthcare Marketers

Track Citations Across Both Platforms

ChatGPT and Google have fundamentally different trust signals. You may be winning citations in one platform and invisible in the other. Measure both.

Query Type Matters

Symptom queries, definitions, and treatment searches all pull from different source mixes. Understand which query types your content targets — and who gets cited for each.

Know Your Source Advantage

- Hospital systems: You have an edge on Google AI Overviews

- Government agencies: You have an edge on ChatGPT

- Medical specialty organizations: You have an edge on ChatGPT

- Consumer health media: Neither platform favors you heavily

Google Is Still Testing — ChatGPT Has Decided

Google's 10x higher volatility means your visibility there may shift. ChatGPT is more stable — what you see now is likely what you'll get. Plan accordingly.

Video Is Unsettled

If you're considering video for healthcare content, know that Google's approach is still evolving rapidly. The 50+ percentage point swings suggest this is early experimentation, not settled strategy.

Technical Methodology

Data Source: BrightEdge AI Catalyst™

Analysis Approach:

- Healthcare URL-prompt pairs analyzed across three platforms: ChatGPT, Google AI Mode, Google AI Overviews

- 14 weeks of citation data tracked (October 2025 – January 2026)

- Source categorization by type: Government (.gov), Elite Hospital Systems, Medical Specialty Organizations, Consumer Health Media, Video, Crisis/Support, Wikipedia, and others

- Query intent categorization: Definition, Symptom, Treatment, Condition-Specific, Find Care/Provider, General Health

- Volatility measured using coefficient of variation (CV) and week-over-week percentage point changes

Data Volume:

- ChatGPT: 13,181 URL-prompt pairs

- Google AI Mode: 52,876 URL-prompt pairs

- Google AI Overviews: 47,500 URL-prompt pairs

Measurement Period:

- Citation tracking: October 2025 – January 2026

- Volatility analysis: 14-week rolling window

Key Takeaways

- Different Trust Anchors: ChatGPT pulls 27% from government, 1% from elite hospitals. Google AI Overviews pulls 33% from elite hospitals, 10% from government. Fundamentally different definitions of healthcare authority.

- Symptom Queries Diverge Most: ChatGPT cites major hospital systems for 57% of symptom queries vs. Google's 18-20%. ChatGPT concentrates trust; Google distributes it.

- ChatGPT Is 10x More Stable: Google's healthcare citations show 20% volatility vs. ChatGPT's 2%. Google is experimenting; ChatGPT has decided.

- Neither Trusts Consumer Health Media: Both platforms prefer official sources over popular health websites by 2-4x ratios.

- Video Is Google's Experiment: Google is testing video (2.7% of citations) while ChatGPT cites none. But 50pp swings suggest Google hasn't settled on whether video belongs in YMYL healthcare.

- Query Type Determines Source Mix: Different query intents (symptoms vs. definitions vs. treatments) pull from different source distributions. One-size-fits-all optimization won't work.

Download the Full Report

Download the full AI Search Report — Healthcare AI Citations: How ChatGPT and Google Define Trust Differently

Click the button above to download the full report in PDF format.

Published on January 08, 2026

Finance and AI Overviews: How Google Applies YMYL Principles to Financial Search

Last week we covered Healthcare; this week we focus on Finance (YMYL). We analyzed finance keywords across three years. Google applies similar rules, adapted to financial searches.

Data Collected

We analyzed finance keywords at the same point each December across three years to understand:

- Year-over-year changes in AI Overview deployment rates

- Query type patterns (educational vs. transactional vs. real-time data)

- Category-level expansion patterns within finance

- Comparisons to Healthcare AI Overview deployment

Key Finding

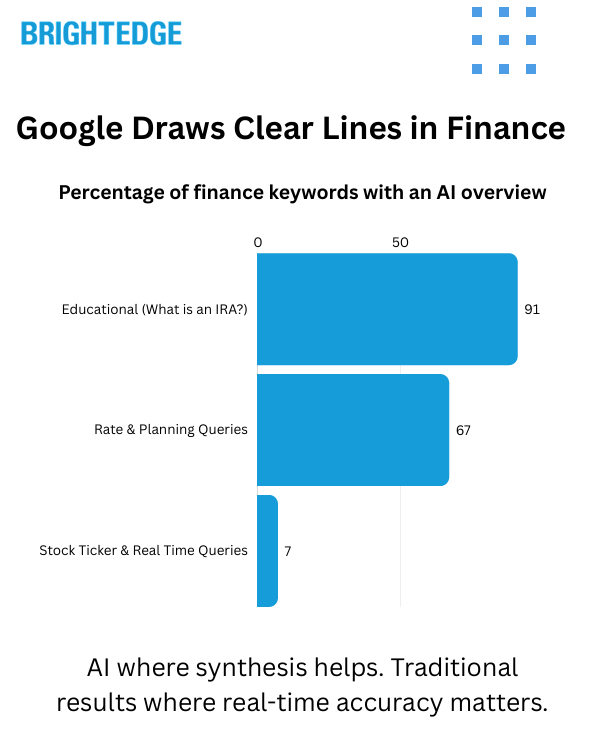

Google draws clear lines in Finance. AI Overview treatment depends entirely on query type: educational queries like "what is an IRA" hit 91% coverage — nearly identical to Healthcare. But real-time price queries like stock tickers sit at just 7%. And just like Healthcare, Google pulled back from local "near me" queries entirely. Same YMYL principles, adapted to different search behaviors.

Google Draws Clear Lines in FinanceGoogle Draws Clear Lines in Finance

AI Treatment Depends on Query Type

Unlike Healthcare's broad 89% coverage across clinical content, Finance shows distinct zones based on what users are trying to accomplish:

- Educational queries ("what is an IRA"): 91% have AI Overviews

- Rate and planning queries: 67% have AI Overviews

- Stock tickers and real-time prices: 7% have AI Overviews

Google uses AI where synthesis adds value — explaining concepts, comparing options, guiding decisions. For live market data where real-time accuracy matters, Google keeps AI out entirely.

The Real-Time Data Decision

Stock ticker queries represent a deliberate exclusion. Queries like "AAPL stock," "Tesla price," and "Microsoft share price" request real-time price data, not information synthesis.

Google's treatment has been consistent:

- December 2023: 5% had AI Overviews

- December 2024: 4% had AI Overviews

- December 2025: 7% have AI Overviews

This isn't a gap Google is trying to close — it's a line they've drawn. Real-time accuracy matters more than AI synthesis for price lookups.

Where Finance Matches Healthcare

Educational Content Gets the Same Treatment

Google treats educational queries nearly identically across both YMYL industries:

- Finance "what is" queries: 91% have AI Overviews

- Healthcare "what is" queries: 95% have AI Overviews

Examples of finance educational queries with AI Overviews:

- "what is an IRA"

- "how does compound interest work"

- "what is dollar cost averaging"

- "what is a derivative"

- "ebitda meaning"

- "what is a bond"

Planning and Guidance Content

Queries seeking financial planning guidance show similar patterns to healthcare treatment queries:

- Retirement planning queries: 61% have AI Overviews

- Rate information queries: 67% have AI Overviews

- Tax-related queries: 55% have AI Overviews

Examples include "rmd table," "capital gains tax rate," "traditional ira vs roth ira," and "what is long term care insurance."

The Local Pullback — Same Story as Healthcare

Google Removed AI From Local Finance Queries

Last week's biggest Healthcare finding: Google pulled AI Overviews from "near me" queries entirely, dropping from 100% coverage in 2023 to 0% in 2025.

Finance shows the same pattern:

- December 2023 (SGE Labs): 90% of local finance queries had AI Overviews

- December 2024: 0% of local finance queries had AI Overviews

- December 2025: ~10% of local finance queries have AI Overviews

The only local query retaining AI coverage is "tap to pay atm near me" — which is more educational about the feature than truly local intent.

Queries Google Removed AI From

- "Chase bank near me" — NO AIO

- "Wells Fargo near me" — NO AIO

- "Bank of America financial center near me" — NO AIO

- "Financial advisors near me" — NO AIO

- "ATM near me" — NO AIO

- "Moneygram near me" — NO AIO

- "Edward Jones near me" — NO AIO

The Implication

Google tested AI on local queries in both Healthcare and Finance during the SGE Labs period. After broader rollout, they pulled back from both. For "near me" queries, it's all about local pack and maps presence — no AI layer to compete with.

Where AI Is Expanding Fast

Post-Google I/O Growth Trajectory

The SGE-to-AIO transition in May 2024 reset the baseline. Since then, Finance educational and planning content has expanded rapidly.

Post-Google I/O growth (June 2024 → December 2025):

- Educational queries: 70% → 91% (+21 percentage points)

- Fixed income (bonds, CDs, treasury bills): 28% → 72% (+44 percentage points)

- Rate information (mortgage rates, HELOC rates): 26% → 67% (+41 percentage points)

- Tax questions: 0% → 55% (+55 percentage points)

Category Examples

Educational queries include "what is an IRA," "what is dollar cost averaging," "how does compound interest work," and "ebitda meaning."

Fixed income queries include "what is a bond," "treasury bill rates," "cd rates," and "fixed income investments."

Rate information queries include "interest rates today," "current mortgage rates," "heloc rates," "money market rates," and "home equity loan rates."

Tax queries include "capital gains tax rate," "federal tax brackets," and "tax free municipal bonds."

What This Growth Means

If you rank for educational finance content — retirement planning guides, tax explainers, investment education — you're now competing for citations, not just clicks. Traffic may decline even if rankings hold steady, because AI is answering these queries directly.

What Google Keeps AI Out Of

Google has drawn clear lines around query types where AI Overviews don't appear:

Real-Time Price Data

- Individual stock tickers: 7% have AI Overviews

- Market indices: Low AI coverage

- Live price queries: Traditional results dominate

Examples: "AAPL stock," "Tesla price," "dow jones industrial average today," "S&P 500 futures"

Google recognizes that real-time accuracy matters more than AI synthesis for price lookups. These high-volume queries still play by traditional ranking rules.

Local Services

- "Chase bank near me" — NO AIO

- "Wells Fargo near me" — NO AIO

- "Financial advisors near me" — NO AIO

- "ATM near me" — NO AIO

Google determined that local pack results and Maps integrations serve users better than AI summaries for finding bank branches, ATMs, and financial advisors.

Calculator and Tool Queries

- Finance calculator queries: 9% have AI Overviews

- Examples without AI: "401k calculator," "mortgage calculator," "investment calculator," "compound interest calculator"

Users want interactive tools, not AI explanations. Google serves the tools directly.

Brand and Login Queries

- Brand login queries: 0-4% have AI Overviews

- Examples: "fidelity login," "charles schwab login," "td ameritrade login," "robinhood"

Navigational queries go straight to the destination — no AI summary needed.

Finance vs Healthcare: Side-by-Side Comparison

||Healthcare|Finance|

|Educational Query AIO Rate|95%|91%|

|Local "Near Me" AIO Rate|0%|~10%|

|Real-Time Data AIO Rate|N/A|7% (tickers)|

|Overall Trajectory|Near saturation (89%)|Rapid expansion|

|YoY Growth (2024→2025)|+4.6pp|Growing fast in educational categories|

The pattern is consistent: Google uses AI where synthesis adds value (education, explanation, planning) and keeps AI out where real-time accuracy or local relevance matters (live prices, market data, "near me" searches).

Technical Methodology

Data Source: BrightEdge Generative Parser™

Analysis Approach:

- Finance keywords analyzed at equivalent points in December 2023, December 2024, and December 2025

- AI Overview presence tracked by category (L1/L2 taxonomy) and query type

- Query types segmented: educational, rate/planning, real-time/transactional, local intent

- Local intent queries identified and tracked separately

- Trendline data analyzed for post-I/O growth trajectory

Measurement Periods:

- December 2023 snapshot: December 29, 2023

- December 2024 snapshot: December 29, 2024

- December 2025 snapshot: December 26, 2025

- Trendline data: Daily tracking November 2023 through December 2025

Key Takeaways

- Google Draws Clear Lines: AI treatment in Finance depends entirely on query type — 91% for educational, 67% for rates/planning, 7% for stock tickers.

- Educational Content Matches Healthcare: "What is" queries hit 91% AI Overview coverage in Finance — nearly identical to Healthcare's 95%.

- Real-Time Data Stays Out: Stock tickers, market indices, and live price queries sit at 7% AI coverage. Google keeps AI out where real-time accuracy matters.

- Local Pullback Confirmed: Google removed AI from "near me" finance queries just like Healthcare. Bank branches, ATMs, and financial advisors "near me" show minimal AI coverage.

- Rapid Expansion Underway: Educational and planning categories grew 20-55 percentage points in one year. Tax, fixed income, and rate queries are expanding fast.

- Same Principles, Different Application: Both YMYL industries show identical patterns — AI for education, traditional results for local and real-time data.

Industry Implications:

This research confirms that Google applies consistent YMYL principles across industries while adapting to category-specific search behaviors.

For financial services marketers, the implications are significant:

Educational content = New metrics. Retirement planning guides, tax explainers, investment education, "what is" content — expect AI Overviews on most of these queries. If traffic declined while rankings held steady, AI — not your content — is likely the cause. Track citations, not just clicks.

Real-time data = Traditional rankings. Stock prices, market indices, ticker lookups — Google keeps AI out. These high-volume queries still play by traditional ranking rules. Position tracking tells the full story here.

Local "near me" = Maps territory. Bank branches, ATMs, financial advisors — no AI layer to compete with. Google Business Profile optimization and local pack presence drive these results.

The expansion continues. Unlike Healthcare (near saturation at 89%), Finance educational content is still growing rapidly. Categories at 55-70% today could reach 80-90% by late 2026. Plan your measurement strategy accordingly.

Two metrics now matter. For educational and planning content, track AI citation presence alongside traditional rankings. For real-time and local queries, traditional position tracking still tells the full story.

Same strategy, different emphasis. Quality content and technical SEO excellence work across both AI and traditional results. Understanding WHERE your visibility lives helps you measure success correctly and allocate resources appropriately.

Download the Full Report

Download the full AI Search Report —Finance and AI Overviews: How Google Applies YMYL Principles to Financial Search

Click the button above to download the full report in PDF format.

Published on January 03, 2026

Finance and AI Overviews: How Google Applies YMYL Principles to Financial Search

Healthcare and AI Overviews: How Google Sharpened Its Approach Over Three Years

Using BrightEdge Generative Parser™, we tracked healthcare keywords over three annual snapshots (Dec 2023, 2024, and 2025). The data shows Google increasing AI-related content in clinical topics, while reducing focus on local and sensitive health queries.

Data Collected

We analyzed healthcare keywords at the same point each December across three years to understand:

- Year-over-year changes in AI Overview deployment rates

- Query type patterns (clinical vs. local vs. sensitive topics)

- Specialty-level expansion patterns within healthcare

- Stability and volatility trends over time

Key Finding

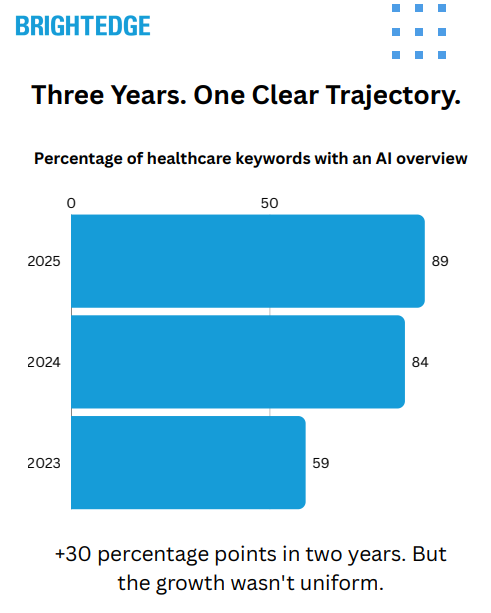

Google expanded AI Overview coverage in healthcare from 59% to 89% over two years — but drew clear boundaries. Clinical content is now near-saturated (93-100% coverage), while local "near me" queries saw a complete reversal: from 100% AI Overview presence in 2023 to 0% today. Google isn't treating all healthcare queries the same. They're matching AI presence to query type — and they've stabilized their approach.

The Three-Year Transformation

December 2023: 59% of Keywords Had AI Overviews

In late 2023, Google was still in expansion mode with AI Overviews (then called SGE). Healthcare showed moderate coverage, with roughly six in ten queries triggering an AI-generated response.

This was the testing phase. Google was learning where AI helped users and where it created problems — particularly in a Your Money Your Life (YMYL) category like healthcare.

December 2024: 84% of Keywords Had AI Overviews

The biggest expansion happened between 2023 and 2024. AI Overview presence jumped 25 percentage points in a single year as Google rolled out the feature broadly following Google I/O 2024.

Healthcare saw aggressive growth across most clinical categories during this period.

December 2025: 89% of Keywords Have AI Overviews

Growth continued but decelerated significantly — just 5 percentage points year-over-year. This suggests Google has reached near-saturation for the query types it intends to cover.

The slower growth isn't hesitation. It's refinement. Google drew lines on where AI belongs in healthcare search.

The Intent Interpretation

The 30 percentage point expansion from 2023 to 2025 wasn't uniform. It reflects Google's learning about healthcare search intent:

- Clinical information intent → Heavy AI treatment (symptoms, treatments, conditions)

- Local provider intent → AI removed entirely (Google reversed course)

- Sensitive health topics → AI consistently excluded (crisis, mental health)

Google is matching SERP treatment to query risk profile, not just search volume or category.

Where Google Went All-In: Clinical Content

Query Type Breakdown (December 2025)

Treatment and procedure queries now show 100% AI Overview presence — up from 45% in 2023. This represents a 55 percentage point increase.

Pain-related queries show 98% AI Overview presence — up from 58% in 2023. This represents a 40 percentage point increase.

Symptoms and conditions queries show 93% AI Overview presence — up from 57% in 2023. This represents a 36 percentage point increase.

Medical coding queries (ICD-10, CPT) show 90% AI Overview presence — up from 67% in 2023. This represents a 23 percentage point increase.

What This Means for Clinical Content

If you're measuring organic traffic on treatment pages, symptom guides, or condition explainers — and seeing declines while rankings hold steady — AI Overviews are likely the cause.

A Position 1 ranking on "rotator cuff surgery recovery" doesn't deliver the same traffic it did in 2023. The AI Overview answers the query before users reach organic results.

The Specialty Breakdown

- Google's expansion varied significantly by medical specialty. Core clinical specialties saw the highest coverage:

- Genetic/Genomic content: 97% have AI Overviews (up from 63% in 2023)

- Cardiology content: 96% have AI Overviews (up from 63% in 2023)

- Urology content: 96% have AI Overviews (up from 68% in 2023)

- Gastroenterology content: 94% have AI Overviews (up from 41% in 2023)

- Orthopedics content: 94% have AI Overviews (up from 63% in 2023)

- Neurology content: 89% have AI Overviews (up from 64% in 2023)

- Lower coverage categories include:

- Primary Care content: 74% have AI Overviews (up from 66% in 2023)

- Mental Health/Behavioral content: 63% have AI Overviews (up from 58% in 2023)

- Eating Disorders content: 63% have AI Overviews (up from 32% in 2023)

- The pattern: clinical specialties with clear diagnostic and treatment pathways saw the most aggressive expansion. Categories intersecting with sensitive topics or local intent saw more conservative treatment.

Where Google Pulled Back: The Reversal Story

Local "Near Me" Queries: 100% → 0%

This is the most significant finding in the data. Google completely reversed its approach to local healthcare searches.

- December 2023: 100% of local/provider intent queries had AI Overviews

- December 2024: 14% of local/provider intent queries had AI Overviews

- December 2025: 0% of local/provider intent queries have AI Overviews

Queries affected include searches like "dermatologist near me," "cardiologist near me," "pediatric dentist near me," and "best family doctor near me."

Google tested AI Overviews on these queries. Then removed them entirely.

Why This Matters

User-Generated Content

For healthcare practices, clinics, and hospital systems: your local SEO investment still pays off. Google has decided — at least for now — that local healthcare provider searches should be handled by traditional local results (Maps, local pack, organic listings) rather than AI summaries.

The queries that drive new patient acquisition remain traditional SEO territory.

Visual and Imaging Content: 45% → 30%

Queries seeking medical images, X-rays, or diagnostic visuals also saw Google pull back:

- December 2023: 45% had AI Overviews

- December 2025: 30% have AI Overviews

Queries like "broken ankle x-ray," "MRI results interpretation," and "skin cancer pictures" don't lend themselves to text-based AI summaries. Google recognized this and reduced coverage.

This creates an opportunity: image-rich medical content faces less AI competition than text-based clinical content.

Where Google Consistently Excludes AI

Some healthcare topics have shown zero or near-zero AI Overview presence across all three years. Google has clearly made policy decisions to keep AI out of these areas:

Consistently Excluded (0% AI Overviews)

- Self-harm and suicide-related queries

- Specific eating disorder names (anorexia, bulimia)

- Crisis intervention terminology

- Addiction-related queries

Consistently Low Coverage

- Mental health crisis terminology

- Abuse-related queries

- Visual diagnostic content

The Implication

If your content focuses on sensitive mental health topics, traditional SEO fundamentals still apply. Rankings matter. Featured snippets matter. AI isn't intercepting these users — Google has determined that human-curated results are more appropriate.

The Stability Factor: Volatility Is Over

Early 2024: High Volatility

If your content focuses on sensitive mental health topics, traditional SEO fundamentals still apply. Rankings matter. Featured snippets matter. AI isn't intercepting these users — Google has determined that human-curated results are more appropriate.

Late 2025: Stable Deployment

By late 2025, monthly volatility dropped to approximately 5 percentage points. Google has settled into a steady state.

What This Means for Planning

The wild experimentation phase is over. What you see now is Google's established approach to healthcare AI Overviews. You can plan content strategy around these patterns with reasonable confidence they'll persist.

Search Volume Analysis

AI Overview deployment in healthcare does not significantly vary by search volume:

- High volume keywords (100K+ monthly searches): 89% have AI Overviews

- Medium volume keywords (10K-100K monthly searches): 88% have AI Overviews

- Low volume keywords (1K-10K monthly searches): 89% have AI Overviews

- Very low volume keywords (under 1K monthly searches): 100% have AI Overviews

Google isn't reserving AI Overviews for high-traffic queries. Even long-tail, low-volume medical queries now predominantly feature AI-generated responses.

The decision factor isn't volume — it's query type and intent.

Technical Methodology

Data Source: BrightEdge Generative Parser™

Analysis Approach:

- Healthcare keywords analyzed at equivalent points in December 2023, December 2024, and December 2025

- AI Overview presence tracked by specialty area (L2 taxonomy) and query type

- Query intent patterns categorized by clinical, local, sensitive, and visual content types

- Stability measured by monthly variance in AI Overview deployment rates

Measurement Periods:

- December 2023 snapshot: December 22, 2023

- December 2024 snapshot: December 22, 2024

- December 2025 snapshot: December 22, 2025

- Trendline data: Daily tracking November 2023 through December 2025

All figures expressed as percentages to protect proprietary dataset composition.

Key Takeaways

- The Coverage Expansion: Healthcare AI Overview presence grew from 59% to 89% over two years — a 30 percentage point increase. Most growth occurred between 2023 and 2024.

- The Clinical Saturation: Treatment queries (100%), pain-related queries (98%), and symptom queries (93%) are now near-fully covered by AI Overviews. Clinical content is AI territory.

- The Local Reversal: "Near me" and provider-finding queries went from 100% AI Overview coverage in 2023 to 0% in 2025. Google completely reversed course on local healthcare search.

- The Sensitivity Boundaries: Self-harm, eating disorder names, crisis terms, and addiction queries remain consistently excluded from AI Overviews across all three years.

- The Specialty Pattern: Clinical specialties (Cardiology, Gastro, Ortho) show 94-97% coverage. Mental health and primary care show 63-74% coverage.

- The Stability Shift: Monthly volatility dropped from ~20 percentage points in early 2024 to ~5 percentage points in late 2025. Google's approach has stabilized.

Industry Implications:

This research confirms that Google's AI Overview strategy for healthcare has moved from experimentation to established policy. The testing phase produced clear conclusions that now govern deployment.

For healthcare marketers and SEO professionals, the implications are significant:

The landscape has bifurcated. Clinical information queries are AI territory — expect AI Overviews on nearly every symptom, treatment, or condition query. Local provider queries remain traditional SEO territory — Google removed AI entirely.

Traffic declines may not indicate content problems. If your clinical content shows declining traffic while rankings hold steady, AI Overviews — not content quality — are likely the cause. Adjust your success metrics accordingly.

Local SEO still delivers. For practices, clinics, and hospital systems focused on patient acquisition, Google Business Profile optimization and local search fundamentals still drive results. Google kept AI out of these queries.

Sensitive content follows traditional rules. Mental health crisis content, eating disorder resources, and addiction support pages compete in a traditional SERP environment. E-E-A-T signals and authoritative sourcing remain your primary levers.

Two metrics now matter. For clinical content, track AI citation presence alongside traditional rankings. For local content, traditional position tracking still tells the full story.

The system has stabilized. Unlike the volatile deployment of early 2024, Google's current approach appears settled. Plan your 2026 strategy around these patterns with confidence.

Download the Full Report

Download the full AI Search Report — Healthcare and AI Overviews: How Google Sharpened Its Approach Over Three Years

Click the button above to download the full report in PDF format.

Published on December 24, 2025

Healthcare and AI Overviews: How Google Sharpened Its Approach Over Three Years

Black Friday vs. Cyber Monday 2024 vs. 2025: How Google's AI Overview Strategy Evolved in One Year

Using BrightEdge AI Catalyst, we analyzed AI Overview presence around Black Friday and Cyber Monday, comparing 2024 to 2025. After a year of testing, Google drew lines where AI Overviews belong in shopping — and the reveals an intent-based strategy.

Data Collected

We analyzed keywords at the same point heading into Black Friday and Cyber Monday across both years to understand:

- Year-over-year changes in AI Overview deployment rates

- Pixel height changes (how much screen real estate AIOs consume)

- Category-level expansion patterns within eCommerce

- Before/during/after timing patterns around each holiday

- Search volume distribution across keywords with AIOs

Key Finding

Google expanded AI Overviews 3x more aggressively for Black Friday than Cyber Monday — and made them 65% larger year-over-year. The pattern reveals an intent-based strategy: AIOs dominate research moments (Black Friday) while traditional results still own purchase moments (Cyber Monday). Google isn't stepping aside for shopping anymore. They're leaning in — strategically.

The Year-Over-Year Expansion

Black Friday: +106% More Keywords with AIOs

Black Friday saw the most dramatic expansion. The number of keywords triggering AI Overviews more than doubled from 2024 to 2025.

This aligns with Black Friday's role as a research-heavy shopping moment. Consumers are hunting for deals, comparing options, and evaluating purchases. Google's AI Overviews are built for exactly this use case.

Cyber Monday: +37% More Keywords with AIOs

Cyber Monday saw meaningful expansion too — but at roughly one-third the rate of Black Friday.

Cyber Monday has evolved into a more transactional holiday. Shoppers have done their research; now they're ready to buy. Google's more conservative AIO expansion here suggests they recognize that traditional shopping results (carousels, PLAs, retail organic) better serve purchase-ready users.

The Intent Interpretation

The 3x expansion gap isn't random. It reflects Google's learning over the past year:

Research intent → Heavy AIO treatment (Black Friday mindset)

Purchase intent → Traditional results dominate (Cyber Monday mindset)

Google is matching SERP treatment to user intent, not just query volume or category.

The Size Shift: 65% More Screen Real Estate

Pixel Height Comparison

Black Friday AIOs averaged 826px in 2024 and grew to 1,368px in 2025 — a 65.6% increase.

Cyber Monday AIOs averaged 831px in 2024 and grew to 1,370px in 2025 — a 64.9% increase.

AI Overviews aren't just appearing on more keywords — they're consuming significantly more screen real estate when they do appear.

What This Means for Organic Visibility

A Position 1 organic ranking in 2025 sits roughly 540 pixels lower than the same ranking in 2024 — even if your actual position didn't change.

For context: 540 pixels is approximately half a standard desktop viewport. Content that was "above the fold" last holiday season may now require scrolling to reach.

The Q4 Trend

This wasn't a sudden holiday spike. Q4 2025 averaged 1,272px compared to Q4 2024's 823px — a 54.6% increase across the entire quarter. Google committed to larger AIOs heading into the shopping season and maintained that size throughout.

The Ramp-Up Pattern: Google's Pre-Holiday Expansion

2024: Flat Throughout November

In 2024, AI Overview pixel height remained remarkably consistent throughout the holiday shopping window. November 20 saw 821px, the day before Black Friday hit 832px, Black Friday itself was 826px, and Cyber Monday was 831px.

Variation of only ~10px across the entire period. Google appeared to be in testing mode — maintaining a steady presence without significant expansion.

2025: Deliberate Ramp-Up

2025 told a different story. Google progressively expanded AIO presence in the weeks leading up to Black Friday.

Four weeks before Black Friday, pixel height averaged 1,204px. Three weeks before, it grew to 1,298px. Two weeks before, it reached 1,307px. One week before, it hit 1,340px. During holiday week, it peaked at 1,371px.

That's a 14% increase in just four weeks — a clear signal that Google intentionally expanded AIO coverage heading into peak shopping.

The Strategic Implication

For 2026 planning: the optimization window may need to shift earlier. Content that earns AIO citations 3-4 weeks before peak shopping could establish presence before the real estate gets crowded. Waiting until November may be too late.

Category Expansion: Where Google Leaned In

eCommerce Share of AIOs Grew Significantly

On Black Friday, eCommerce's share of keywords with AIOs grew from 6.8% in 2024 to 10.1% in 2025 — a 35% increase. On Cyber Monday, it grew from 7.7% to 10.2% — a 32% increase.

Google didn't just expand AIOs overall — they specifically expanded coverage of shopping-related queries. eCommerce's share of the AIO pie grew by roughly one-third.

High-Volume Shopping Keywords

Keywords with 50,000+ monthly search volume that triggered AIOs grew from approximately 1.7% in 2024 to 2.7% in 2025 — a 59% increase in Google's willingness to serve AIOs on high-stakes, high-volume shopping queries.

The Categories That Saw the Biggest Expansion

TV & Home Theater saw the most dramatic growth at +242% for Black Friday and +57% for Cyber Monday. Electronics followed with +75% for Black Friday and +44% for Cyber Monday. Small Kitchen Appliances grew +43% for Black Friday and +42% for Cyber Monday.

These are core gift categories — and exactly where shoppers do the most research before purchasing. Queries like "best 65 inch tv," "ninja vs vitamix," and "top chromebooks" now live in AIO territory.

What Stayed Flat

Apparel saw slight contraction (-4% to -9%) and Home Furnishings declined (-29% to -30%). Google appears more aggressive with AIOs in categories where research and comparison shopping dominate, less aggressive where visual browsing and personal taste drive decisions.

The "No Pullback" Finding

Did Google Step Aside During Peak Shopping?

One theory heading into 2025 was that Google might reduce AIO presence during actual shopping days — letting transactional results take over when users are ready to buy.

The data says otherwise.

Black Friday 2025 Timing Distribution

Keywords with AIOs were distributed almost perfectly across the window: 33.3% the day before, 33.3% on Black Friday itself, and 33.4% the day after. Google maintained consistent AIO presence throughout the shopping window — no pullback during the peak.

Cyber Monday 2025 Timing Distribution

Same pattern: 33.5% the day before, 33.4% on Cyber Monday, and 33.2% the day after. Google isn't temporarily stepping aside for shopping moments anymore. AIOs are a persistent feature of the shopping SERP.

What Google Learned (And What It Means)

The 2024 Testing Phase

Last year's flat pixel heights and moderate expansion suggested Google was still experimenting — testing where AIOs helped users and where they got in the way.

The 2025 Commitment

This year's data shows Google has reached conclusions:

AIOs help shoppers research. The massive Black Friday expansion (research mode) vs. moderate Cyber Monday expansion (purchase mode) shows Google matching AIO presence to intent.

Bigger AIOs don't hurt engagement. The 65% size increase suggests Google's internal metrics support larger AI-generated content blocks for shopping queries.

Category matters. Electronics, appliances, and TV/home theater saw aggressive expansion. Apparel and furnishings didn't. Google is selective about where AIOs add value.

Timing matters less than expected. No significant pullback during peak shopping days means AIOs are now a permanent fixture, not a situational feature.

Strategic Implications for Brands

Two Metrics Now Matter

The old model: track your rank position, measure traffic.

The new model: track two different metrics depending on query intent.

For research queries (Black Friday mindset): Track citation share in AI Overviews and visibility within AIO content. These queries saw the heaviest AIO expansion.

For purchase queries (Cyber Monday mindset): Track traditional rank position, Shopping carousel presence, and PLA performance. These queries saw more conservative AIO growth.

Same content calendar. Different success metrics depending on intent.

The Optimization Window Shifted

2024: Optimize in November, compete during peak shopping.

2025+: Optimize in October (or earlier), establish AIO presence before the ramp-up begins.

Google's 14% pre-holiday expansion suggests that waiting until the shopping season to optimize for AIOs puts you behind brands who started earlier.

Category-Specific Planning

If you're in TV/Electronics/Small Appliances: AIOs are now a major part of your competitive landscape. These categories saw the biggest expansion — TV & Home Theater grew +242%, Electronics +75%, and Small Kitchen Appliances +43%. Plan for AIOs as a persistent SERP feature.

If you're in Apparel/Home Furnishings: AIOs expanded less aggressively — Apparel contracted slightly and Home Furnishings declined significantly. Traditional SEO may still deliver more impact than AIO-specific strategies in these categories.

Technical Methodology

Data Source: BrightEdge AI Catalyst

Analysis Approach:

- Keywords analyzed at equivalent points around Black Friday and Cyber Monday in 2024 and 2025

- AI Overview presence tracked by date, industry, and category

- Pixel height data tracked daily throughout Q4 2024 and Q4 2025

- Search volume distribution analyzed across keywords with AIOs

- Category-level breakdowns by L0/L1 taxonomy

Measurement Periods:

- Black Friday 2024: November 28-29, 2024

- Cyber Monday 2024: December 1-3, 2024

- Black Friday 2025: November 27-29, 2025

- Cyber Monday 2025: November 30 - December 2, 2025

Pixel Height Tracking: Daily averages across tracked keyword set

Key Takeaways

The Expansion Gap: Black Friday saw +106% more keywords with AIOs YoY; Cyber Monday saw +37%. Google expanded 3x more aggressively for research moments than purchase moments.

The Size Shift: AI Overviews grew 65% larger YoY (~826px → ~1,368px). Same rankings now mean less visibility above the fold.

The Ramp-Up Pattern: 2025 showed a 14% increase in AIO pixel height in the 4 weeks before Black Friday. 2024 was flat. Google now deliberately expands heading into peak shopping.

The Category Story: TV & Home Theater (+242%), Electronics (+75%), and Small Kitchen Appliances (+43%) saw the biggest AIO expansion. Core gift categories are now AIO territory.

The No-Pullback Reality: Google maintained consistent AIO presence before, during, and after both holidays. No stepping aside for peak shopping.

The Intent Strategy: Google matches AIO presence to user intent — heavy for research, lighter for purchase. Your metrics should do the same.

Industry Implications:

This research confirms that Google's AI Overview strategy for shopping has moved from experimentation to execution. The 2024 testing phase produced clear conclusions that drove 2025's deliberate expansion.

For SEO and digital marketing professionals, the implications are significant:

The SERP you optimized for last holiday season no longer exists. Position 1 sits 540+ pixels lower than it did in 2024. AIO citation share is now a critical metric for research-phase queries.

Intent segmentation is essential. A single "holiday SEO strategy" no longer makes sense. Research queries and purchase queries require different optimization approaches and different success metrics.

The optimization window moved earlier. Google's pre-holiday ramp-up means establishing AIO presence in October, not November. Brands who wait until peak shopping to optimize are already behind.

Google is committed to AIOs for shopping. The theory that Google would step aside during peak transactional moments has been disproven. AIOs are a permanent fixture of the shopping SERP — plan accordingly for Holiday 2026.

Download the Full Report

Download the full AI Search Report — Black Friday vs. Cyber Monday 2024 vs. 2025: How Google's AI Overview Strategy Evolved in One Year

Click the button above to download the full report in PDF format.

Published on December 10, 2025

Black Friday vs. Cyber Monday 2024 vs. 2025: How Google's AI Overview Strategy Evolved in One Years

Who Does AI Trust When You Search for Deals? Google vs. ChatGPT Citation Patterns Reveal Different Shopping Philosophies

Using BrightEdge AI Catalyst, we analyzed tens of thousands of eCommerce prompts across Google AI Overviews and ChatGPT during the holiday shopping season. The citation patterns reveal two fundamentally different approaches to helping users shop.

Data Collected

Analyzed citation sources across both AI platforms to understand:

.png)

- Which domains each AI cites for shopping queries

- Retailer vs. third-party citation distribution

- How the same queries produce different source selections

- The underlying philosophy driving each platform's approach

Key Finding

Google AI Overviews cite retailers only ~4% of the time, leaning heavily on YouTube, Reddit, and editorial sources. ChatGPT cites retailers ~36% of the time — a 9x difference. The reason? Google's AIOs sit above Shopping carousels that handle transactions, so they can focus on research. ChatGPT has to serve both needs in one response.

The Citation Divide

Google AI Overviews: "The Crowd"

Top cited sources for shopping queries:

- YouTube

- Quora

- Amazon

Retailer share of citations: ~4%

Google's AI Overviews lean heavily on user-generated content and editorial sources. YouTube product reviews, Reddit discussions, and Quora Q&A threads dominate the citation landscape for eCommerce queries.

ChatGPT: "The Store"

Top cited sources for shopping queries:

- Amazon

- Target

- Walmart

- Home Depot

- Best Buy

Retailer share of citations: ~36%

ChatGPT's citations skew heavily toward retailers and product pages. Major marketplaces and retail sites appear at the top, with editorial and UGC sources playing a smaller role.

Same Query, Different Sources

Example: "Costco TV Sale"

Google AI Overview cites:

- Reddit (most frequent)

- YouTube

- Welcome to Costco Wholesale (third)

ChatGPT cites:

- Welcome to Costco Wholesale (most frequent)

- Scattered others

When users search for a specific retailer's deals, Google still routes them through community discussion first. ChatGPT goes directly to the source.

Example: "Best Immersion Blender"

Google AI Overview cites:

- Serious Eats

- Food & Wine

- The Spruce Eats

- CNET

- YouTube

ChatGPT cites:

- Amazon

- Consumer Reports

For research-phase queries, Google cites editorial reviews and recipe sites. ChatGPT cites the marketplace where you can buy immediately.

Why the Difference? Context Matters

Google's Advantage: The Full SERP

Google AI Overviews don't exist in isolation. They sit atop a full search results page that includes:

- Shopping carousels with product listings

- Product listing ads (PLAs)

- Organic retailer results

- Price comparisons

Because the transactional elements already exist below the AI Overview, Google can afford to make the AIO purely informational. The citation strategy reflects this: cite the crowd for research, let Shopping results handle the purchase.

ChatGPT's Reality: One Response

ChatGPT doesn't have a Shopping carousel underneath. The AI response IS the entire experience. This forces ChatGPT to serve both needs simultaneously:

- Provide helpful product information

- Give users a path to purchase

The higher retailer citation rate reflects this necessity — ChatGPT has to be both the research assistant AND the shopping guide.

What Each AI Prioritizes

Google AI Overviews Prioritize:

User-Generated Content

- YouTube product reviews and unboxings

- Reddit community discussions (r/BuyItForLife, r/Appliances, brand-specific subreddits)

- Quora Q&A threads

Editorial Reviews

- Serious Eats, Food & Wine, The Spruce Eats (kitchen products)

- Rtings, CNET, Consumer Reports (electronics)

- Wirecutter, TechRadar, Tom's Guide (tech products)

Why: Google assumes users in the AI Overview are still researching. The shopping infrastructure below handles conversion.

ChatGPT Prioritizes:

Major Retailers

- Amazon (dominant across categories)

- Target, Walmart (general merchandise)

- Home Depot, Lowe's (home improvement)

- Best Buy (electronics)

Brand Sites

- Manufacturer product pages

- Brand-specific information

Editorial (Secondary)

- Consumer Reports

- Category-specific review sites

Why: ChatGPT needs to provide a complete answer, including where to buy. Retailer citations serve that need directly.

The Philosophy Behind the Citations

Google's Approach: "What Do Real People Say?"

Google's citation pattern reveals a philosophy of objectivity through community consensus. By citing YouTube reviewers, Reddit discussions, and editorial reviews, AI Overviews position themselves as aggregators of authentic opinion.

This makes strategic sense: Google doesn't need to push users toward purchase — the Shopping results, PLAs, and retail organic listings already do that. The AIO can focus purely on being helpful for research.

ChatGPT's Approach: "Where Can You Get This?"

ChatGPT's citation pattern reveals a philosophy of utility through directness. By citing retailers and product pages, ChatGPT aims to shorten the path from question to purchase.

This also makes strategic sense: without a commercial infrastructure below the response, ChatGPT serves users best by including purchase pathways directly in the answer.

Strategic Implications for Brands

Understanding Visibility Across Platforms

The same content can surface differently depending on which AI a user asks. Brands should monitor visibility across both platforms:

On Google AI Overviews, look for:

- YouTube content citations

- Reddit/community mentions

- Editorial review coverage

- UGC and social proof signals

On ChatGPT, look for:

- Retail listing citations

- Product page references

- Marketplace presence

- Brand site mentions

Content That Works Across Both

Quality content surfaces on both platforms — but in different contexts:

- Product reviews on YouTube → Cited by Google AIOs

- Strong Amazon listings → Cited by ChatGPT

- Editorial coverage → Cited by both (Google more frequently)

- Brand product pages → Cited by ChatGPT primarily

The Monitoring Framework

Rather than building separate strategies, brands should track where their content appears:

YouTube reviews

- Google AIO Visibility: High

- ChatGPT Visibility: Low

Reddit presence

- Google AIO Visibility: High

- ChatGPT Visibility: Low

Editorial coverage

- Google AIO Visibility: High

- ChatGPT Visibility: Medium

Retail listings

- Google AIO Visibility: Low

- ChatGPT Visibility: High

Product pages

- Google AIO Visibility: Low

- ChatGPT Visibility: HighRetryClaude can make mistakes. Please double-check responses.

Your content surfaces differently on each platform. Use AI search tracking tools to monitor:

- Which of your pages get cited on Google AIOs

- Which get cited on ChatGPT

- How citation patterns shift over time

Understand What Drives Citations

For Google AIO visibility:

- Invest in YouTube product content

- Engage authentically in Reddit communities

- Pursue editorial review coverage

- Create content that answers "which should I buy?" questions

For ChatGPT visibility:

- Optimize retail listings and product pages

- Ensure strong marketplace presence

- Keep product information current and comprehensive

- Maintain accurate brand site content

Let Each Platform Do Its Job

Google cites the crowd because Shopping results handle transactions. ChatGPT cites retailers because it has to do both. Your content strategy doesn't need to force either platform to behave differently — optimize your content, and each AI will use it where it fits.

Coming Next

This analysis focused on citation patterns — which sources each AI trusts for shopping queries.

Up next: Our full Black Friday and Cyber Monday post-mortem, examining how Google's AI Overview strategy evolved from 2024 to 2025 and what it signals for holiday shopping in 2026.

Technical Methodology

Data Source: BrightEdge AI Catalyst

Analysis Approach:

- eCommerce prompts analyzed across Google AI Overviews and ChatGPT

- Citation sources extracted and categorized by domain

- Domains classified by type (retailer, UGC/social, editorial, brand)

- Same prompts compared across platforms where possible

- Week-over-week citation changes tracked

Measurement Periods:

Holiday Shopping Season 2025

Key Takeaways

- The 4% vs. 36% Divide: Google AIOs cite retailers ~4% of the time; ChatGPT cites retailers ~36% — a 9x difference

- The Source Hierarchy: Google leads with YouTube/Reddit/Quora; ChatGPT leads with Amazon/Target/Walmart

- The Context Explanation: Google can focus on research because Shopping results handle purchase; ChatGPT has to do both

- The Same-Query Difference: Identical searches produce different source selections based on each platform's philosophy

- The Strategic Reality: Brands should monitor visibility on both platforms and understand where their content surfaces

Industry Implications:

This research reveals that "AI search optimization" isn't a single discipline — it's platform-specific based on how each AI approaches user intent.

Google's AI Overviews operate as a research layer above a transactional infrastructure. ChatGPT operates as a complete response that must serve multiple needs simultaneously. These different contexts drive fundamentally different citation strategies.

For brands, the implication is clear: the same content can win on both platforms, but understanding where and why each AI cites sources helps you measure success accurately. Track your visibility across both scoreboards, and optimize content that serves users at every stage of the journey.

Download the Full Report

Download the full AI Search Report — Who Does AI Trust When You Search for Deals? Google vs. ChatGPT Citation Patterns Reveal Different Shopping Philosophies

Click the button above to download the full report in PDF format.

Published on December 03, 2025

Who Does AI Trust When You Search for Deals? Google vs. ChatGPT Citation Patterns Reveal Different Shopping Philosophies

Black Friday 2024 vs. 2025: What a Year of Testing Taught Google About AI Overviews

Using BrightEdge AI Catalyst, we analyzed thousands of keywords heading into Black Friday/Cyber Monday — comparing November 2024 vs. November 2025. After a year of testing, Google now shows clear patterns on where AI Overviews fit in the shopping journey.

Data Collected: Analyzed AI Overview presence patterns year-over-year to understand:

- Overall AI Overview expansion by industry

- Intent-based presence patterns in eCommerce

- Search volume correlation with AI Overview appearance

- Category-level shifts in AI treatment

- Google's strategic decisions on research vs. purchase queries

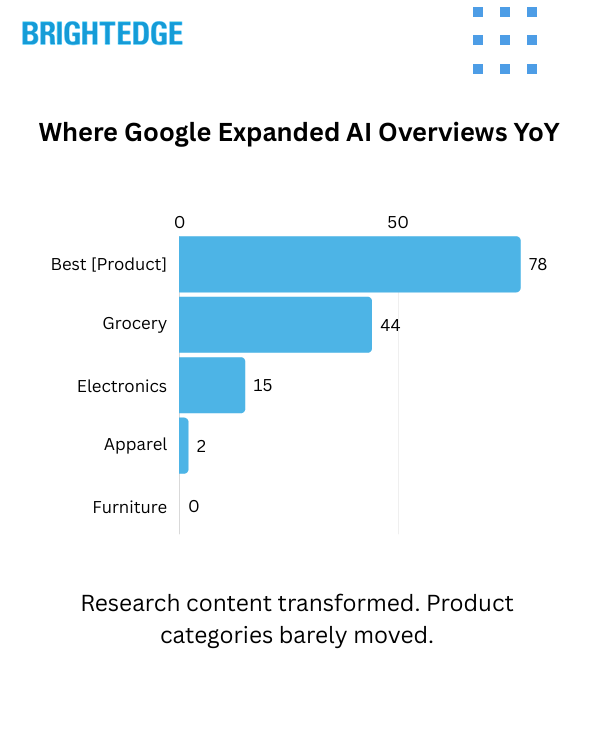

Key Finding: Google expanded AI Overview presence from 34% to 46% overall (+12pp), but eCommerce sits at just 16% while all other industries average 58%. Within shopping queries, intent determines everything: "best [product]" queries exploded from 5% to 83% AI presence, while transactional and pure product queries remained flat at 13-14%. Google learned that AI helps shoppers research but gets in the way when they're ready to buy.

The Year-Over-Year Shift

The Headline Numbers

November 2024: 34% of all keywords had AI Overviews

November 2025: 46% of all keywords have AI Overviews

But that +12pp growth is not evenly distributed. Google got highly selective.

The Industry Divide

eCommerce: 16% AI Overview presence

All Other Industries: 58% AI Overview presence

Google expanded AI aggressively everywhere — except shopping. That's not an accident.

Where Google Expanded AI Overviews YoY

The Biggest Gainers

The categories and query types that saw dramatic AI Overview expansion:

- "Best [product]" queries: 5% → 83% (+78pp)

- Grocery/Food: 5% → 49% (+44pp)

- Entertainment: 4% → 47% (+43pp)

- Travel: 32% → 57% (+25pp)

- Electronics: 9% → 24% (+15pp)

- TV & Home Theater: 13% → 25% (+12pp)

- Small Kitchen Appliances: 13% → 24% (+10pp)

Google leaned heavily into research and consideration content.

Where Google Held Back

Meanwhile, transactional shopping categories barely moved:

- Apparel: 8% → 11% (+2pp)

- Home: 10% → 9% (-1pp)

- Furniture: 2% → 2% (flat)

- Pure product queries: Still under 15%

High-volume purchase terms like "65 inch tv" or "mens sneakers" remain AI Overview-free zones.

The Intent Line Google Drew

Query Intent Determines AI Presence

Forget categories. The real pattern within eCommerce is intent:

- Informational Queries ("best air fryer"): 83% have AI Overviews

- Transactional Queries ("buy air fryer"): 13% have AI Overviews

- Pure Product Names ("air fryer"): 14% have AI Overviews

The "Best" Query Explosion

The single biggest YoY shift in our entire dataset:

- 2024: 5% of "best [product]" queries had AI Overviews

- 2025: 83% of "best [product]" queries have AI Overviews

That's a +78pp swing in one year. If you're ranking for "best" content, the SERP you optimized for last holiday season no longer exists.

What This Tells Us

Google spent 2024 figuring out where AI helps versus where it gets in the way. Their conclusion:

- Research Phase: AI Overviews add value

- Purchase Phase: Traditional results close the sale

The data proves it. Informational queries saw massive AI expansion. Transactional queries stayed deliberately protected.

What the Volume Data Reveals

The Unexpected Pattern

Across all industries, we found an inverse relationship between search volume and AI Overview presence:

- Under 1K volume: 45% → 60% (+15pp)

- 1K - 5K volume: 46% → 61% (+15pp)

- 5K - 10K volume: 34% → 46% (+12pp)

- 10K - 50K volume: 26% → 36% (+11pp)

- 50K - 100K volume: 21% → 32% (+12pp)

- 100K+ volume: 20% → 28% (+8pp)

Lower volume keywords consistently have higher AI Overview rates.

But eCommerce Is Different

In eCommerce specifically, AI Overview presence is flat across all volume tiers: 14-19% regardless of search volume.

Translation: Google isn't using search volume to decide which shopping queries get AI treatment. They're using intent signals. A 500K volume product query stays protected while a 5K "best" query gets an AI Overview.

Category Deep Dive: eCommerce

AI Overview Presence by Category (2025)

- Grocery: 5% → 49% (+44pp)

- Electronics: 9% → 24% (+15pp)

- TV & Home Theater: 13% → 25% (+12pp)

- Small Kitchen Appliances: 13% → 24% (+10pp)

- Apparel: 8% → 11% (+2pp)

- Home: 10% → 9% (-1pp)

- Furniture: 2% → 2% (flat)

Why Grocery Stands Out

Grocery saw the largest expansion because food queries blend informational intent with shopping. Queries like "cottage cheese," "prosciutto," or "vegetables" have educational components (nutrition, recipes, preparation) that AI Overviews can address — unlike pure product queries.

Why Furniture Stayed Flat

At just 2% AI Overview presence in both years, furniture represents a category Google has deliberately kept AI-free. High-consideration, high-price purchases appear to warrant traditional search results where users can compare retailers, prices, and options directly.

Holiday Shopping Categories: The Black Friday View

Traditional Black Friday/Cyber Monday Categories

- Computers/Laptops: 6% → 21% (+15pp)

- Small Kitchen Appliances: 13% → 24% (+10pp)

- TVs: 9% → 18% (+9pp)

- Streaming Devices: 35% → 42% (+8pp)

- Apparel: 8% → 11% (+2pp)

- Furniture: 2% → 2% (flat)

The Mattress Reversal

One notable outlier: Mattresses dropped from 44% to 17% AI Overview presence (-27pp). Google appears to have pulled back AIOs for this high-consideration category — possibly recognizing that mattress shoppers need to compare retailers and deals rather than get AI-summarized answers.

The Strategic Implications

Two Metrics for 2025

Last year, your "best [product]" pages competed for Position 1. This year, they compete for AI citations while Position 1 sits below the fold.

This means tracking two different metrics:

- For Research Queries: Are you being CITED in AI Overviews?

- For Purchase Queries: Are you RANKING in organic results?

Same content calendar. Different success metrics depending on intent.

The Dual-Channel Reality

This isn't about AI OR organic anymore. It's both:

- Your "best [product]" content needs to be citation-worthy for AI

- Your product pages need traditional SEO excellence

- Same brand, two battlefronts

What Google Learned (And What You Should Too)

Google tested aggressively in 2024. They kept what worked, pulled back what didn't.

Their conclusion: Let AI guide consideration. Let results close conversion.

The brands who adapt aren't choosing between AI optimization and traditional SEO — they're matching their strategy to Google's intent-based approach.

Strategic Implementation Framework

For Research Content ("Best [Product]" Queries)

Your Reality: 83% of these queries now show AI Overviews

Your Goal: Get cited, not just ranked

Action Items:

- Create comprehensive comparison content that AI can summarize

- Include clear, factual statements that work as citation sources

- Structure content with distinct sections AI can reference

- Update existing "best" content for citation-worthiness

For Product Pages (Transactional Queries)

Your Reality: Only 13-14% show AI Overviews

Your Goal: Win the traditional ranking game

Action Items:

- Traditional on-page SEO still dominates

- Focus on shopping feed optimization

- Product schema markup matters

- Page speed and Core Web Vitals remain critical

For Category Pages

Your Reality: Intent varies by category

Action Items:

- Grocery/Food: Prepare for high AI presence, optimize for citations

- Apparel/Furniture: Traditional SEO focus, minimal AI disruption

- Electronics: Mixed approach — research content needs citation optimization, product pages need ranking focus

Action Items for Holiday 2025

Immediate Actions

- Audit Your "Best" Content: The SERP changed dramatically. Review your top research-phase content for citation-worthiness.

- Segment by Intent: Map your pages to informational vs. transactional buckets. Apply different success metrics to each.

- Check Your Exposure: What percentage of your traffic comes from "best" queries? That's your AI Overview exposure rate.

Content Priorities

High Priority (AI Citation Focus):

- "Best [product]" guides

- Comparison content

- Buyer's guides

- "How to choose" content

Standard Priority (Traditional SEO):

- Product pages

- Category pages

- Brand pages

- Transactional landing pages

Measurement Framework

For Research Queries, Track:

- AI Overview citation presence

- Citation position within AI Overview

- Brand mention frequency

For Purchase Queries, Track:

- Organic rank position

- Click-through rate

- Shopping carousel presence

Technical Methodology

Data Source: BrightEdge AI Catalyst

Analysis Approach:

- Same keyword set pulled at identical time points (Black Friday week 2024 vs. 2025)

- AI Overview presence tracked as binary (yes/no) per keyword

- Intent classification based on query patterns and modifiers

- Volume segmentation using monthly search volume data

- Category taxonomy applied consistently across both years

Measurement Periods: November 2024, November 2025

Key Takeaways

- The 12pp Growth: Overall AI Overview presence grew from 34% to 46%, but distribution is highly uneven

- The 16% vs 58% Divide: eCommerce has dramatically lower AI presence than all other industries

- The 78pp Explosion: "Best [product]" queries saw the largest single shift in AI Overview presence

- The Intent Line: Google drew a clear boundary — AI for research, traditional results for purchase

- The Volume Insight: Search volume doesn't determine AI presence in eCommerce; intent does

The Strategic Reality: Brands need to track citations AND rankings — different metrics for different query types

Industry Implications:

This research reveals that Google has moved past experimentation. After a year of testing, they've made deliberate decisions about where AI Overviews add value in the shopping journey and where they don't.

The implications are clear: the SERP you optimized for last holiday season may no longer exist for research queries, while purchase-intent queries remain largely unchanged. Success in 2025 requires understanding this divide and building a strategy that addresses both realities.

For brands preparing for Black Friday, Cyber Monday, and the holiday season, the principle holds: optimize once, win everywhere. But now you need to measure success differently depending on where in the journey your content lives — and recognize that Google has already decided where AI belongs.

Download the Full Report

Download the full AI Search Report — Black Friday 2024 vs. 2025: What a Year of Testing Taught Google About AI Overviews

Click the button above to download the full report in PDF format.

Published on November 27, 2025

Black Friday 2024 vs. 2025: What a Year of Testing Taught Google About AI Overviews

How Query Intent Shapes Brand Competition Across AI Search Engines

Using BrightEdge AI Catalyst, we analyzed thousands of shopping queries to uncover how ChatGPT, Google AI Mode, and AI Overviews represent brands and where visibility is most competitive across the AI-driven consumer journey.

Data Collected: Analyzed brand mention patterns across three AI search engines to understand:

Brand density variations by query intent

Platform-specific recommendation strategies

Journey stage impact on competitive landscapes

Citation patterns across informational, consideration, and transactional queries

Category-level variance in brand mentions

Key Finding: All three AI engines adapt brand recommendations based on query intent, with consideration queries showing 26% more brand competition than transactional queries. Google AI Mode peaks at 8.3 brands for consideration, while Google AIO mentions only 1.4 brands for informational queries despite appearing 30.3% of the time.

The Intent Framework

Query Classification

Informational: Educational queries where users learn about products ("What is OLED?")

Consideration: Research queries where users evaluate options ("best coffee maker")

Transactional: Purchase-ready queries with commercial intent ("Samsung TV Walmart")

Brand Mention Patterns by Intent

The Universal Pattern

Google AI Mode - Comprehensive Throughout

Informational: 6.6 brands per query

Consideration: 8.3 brands per query

Transactional: 6.6 brands per query

ChatGPT - Journey-Adaptive

Informational: 5.1 brands per query

Consideration: 6.5 brands per query

Transactional: 4.7 brands per query

Google AI Overviews - Selective Presence

Informational: 1.4 brands per query

Consideration: 3.9 brands per query

Transactional: 3.9 brands per query

Overall presence: 18.4% of queries

The Competition Landscape

Highest Competition: Consideration Stage

The 8.3 Brand Reality

AI Mode averages 8.3 brands for consideration queries

ChatGPT follows with 6.5 brands

Even Google AIO jumps to 3.9 brands

26% more competition than transactional stage

Hidden Opportunity: Informational on Google AIO

The 1.4 Brand Advantage

Google AIO appears for 30.3% of informational queries

Mentions only 1.4 brands on average

Lowest competition across all engines and intents

Prime opportunity for educational content

The Transactional Divide

Platform-Specific Strategies

ChatGPT drops to 4.7 brands (28% reduction from consideration)

Google AIO appears only 14.3% of the time

Google relies on shopping carousels for purchase intent

AI Mode maintains 6.6 brands consistently

Citation Patterns Tell Another Story

Authority Signals by Engine

Google AIO: 9-12 citations per query (highest)

AI Mode: 5-8 citations per query

ChatGPT: 4-6 citations per query

Google values source authority more heavily, particularly for informational content.

Google's Strategic Division of Labor

Where AI Overviews Appear

Informational: 30.3% presence (highest)

Transactional: 14.3% presence

Consideration: 13.8% presence

Why the Pattern Makes Sense

Google uses AI Overviews to enhance education and research, while relying on established commerce features (shopping carousels, product grids, merchant listings) for transactional queries. This explains both the low presence and low brand counts for purchase-intent searches.

Category-Level Insights

High Variance Categories

Categories like Furniture show massive swings:

AI Mode: 11.5 brands

ChatGPT: 5.8 brands

AI Overviews: 0.1 brands

Consistent Categories

Small Kitchen Appliances remain steady:

AI Mode: 6.5 brands

ChatGPT: 5.7 brands

AI Overviews: 5.2 brands (when present)

Strategic Implementation Framework

For Consideration Content

Your Biggest Battleground

Create comprehensive comparison guides

Build detailed feature tables

Develop use-case scenarios

Expect to compete with 8+ brands

For Informational Content

Your Best Opportunity

Target "how does X work" queries

Create "what is" educational guides

Build "difference between" content

Capitalize on low competition in Google AIO

For Transactional Content

The Reality Check

Google AIO rarely appears (14.3%)

Traditional SEO still dominates

Focus on shopping feed optimization

Product pages matter more than AI optimization

Platform-Specific Strategies

Google AI Mode Strategy

Consistently high brand mentions require differentiation

Focus on comprehensive content that stands out

36% of queries show 10+ brands

ChatGPT Strategy

Biggest journey adaptation (28% drop at transaction)

Optimize for middle-funnel content

Balance between information and recommendation

Google AIO Strategy

Appears selectively but cites heavily

Win with authoritative educational content

Remember: complements shopping results, doesn't replace them

Action Items for Implementation

Immediate Actions

Audit by Intent: Map your content to informational, consideration, and transactional buckets

Gap Analysis: Where are you missing content for each intent stage?

Competitive Assessment: Count how many competitors appear for your key queries

Content Priorities

Consideration Content: Comparison guides, "best of" lists, evaluation criteria

Informational Content: How-to guides, educational resources, feature explanations

Transactional Optimization: Traditional SEO, shopping feeds, product pages

Technical Methodology

Data Source: BrightEdge AI Catalyst

Tens of thousands shopping-related queries analyzed

Brand mention counts per query

Citation analysis per result

Intent classification based on query patterns

Measurement Period: November 2024

Key Takeaways

The 26% Rule: Consideration queries see 26% more brand competition than transactional

The 8.3 Peak: AI Mode's consideration queries represent maximum brand density

The 1.4 Opportunity: Google AIO's informational queries offer minimal competition

The 18.4% Reality: Most queries still rely on traditional search results

The Journey Principle: All engines adapt to user intent, just differently

_0.png)

Industry Implications:

This research reveals that AI engines understand and respond to the shopping journey. They provide more options during research, streamline choices at purchase, and adapt their strategies to user needs. The implications are clear: one-size-fits-all optimization no longer works.

For brands preparing for the holiday season and beyond, success requires understanding not just what queries to target, but where in the journey those queries fall and how each AI engine will respond. The competitive landscape isn't just about keywords anymore—it's about intent, timing, and platform-specific behavior.

The principle remains: optimize once, win everywhere. But now you know exactly where the battles are being fought.

Download the Full Report

Download the full AI Search Report —How Query Intent Shapes Brand Competition Across AI Search Engines

Click the button above to download the full report in PDF format.

Published on November 20, 2025