Healthcare and AI Overviews: How Google Sharpened Its Approach Over Three Years

Using BrightEdge Generative Parser™, we tracked healthcare keywords over three annual snapshots (Dec 2023, 2024, and 2025). The data shows Google increasing AI-related content in clinical topics, while reducing focus on local and sensitive health queries.

Data Collected

We analyzed healthcare keywords at the same point each December across three years to understand:

- Year-over-year changes in AI Overview deployment rates

- Query type patterns (clinical vs. local vs. sensitive topics)

- Specialty-level expansion patterns within healthcare

- Stability and volatility trends over time

Key Finding

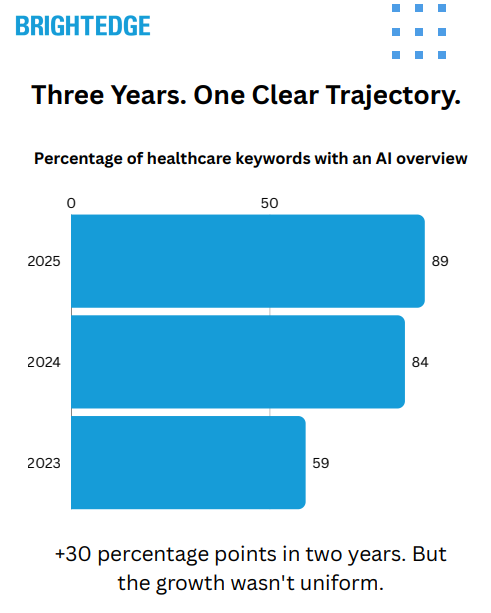

Google expanded AI Overview coverage in healthcare from 59% to 89% over two years — but drew clear boundaries. Clinical content is now near-saturated (93-100% coverage), while local "near me" queries saw a complete reversal: from 100% AI Overview presence in 2023 to 0% today. Google isn't treating all healthcare queries the same. They're matching AI presence to query type — and they've stabilized their approach.

The Three-Year Transformation

December 2023: 59% of Keywords Had AI Overviews

In late 2023, Google was still in expansion mode with AI Overviews (then called SGE). Healthcare showed moderate coverage, with roughly six in ten queries triggering an AI-generated response.

This was the testing phase. Google was learning where AI helped users and where it created problems — particularly in a Your Money Your Life (YMYL) category like healthcare.

December 2024: 84% of Keywords Had AI Overviews

The biggest expansion happened between 2023 and 2024. AI Overview presence jumped 25 percentage points in a single year as Google rolled out the feature broadly following Google I/O 2024.

Healthcare saw aggressive growth across most clinical categories during this period.

December 2025: 89% of Keywords Have AI Overviews

Growth continued but decelerated significantly — just 5 percentage points year-over-year. This suggests Google has reached near-saturation for the query types it intends to cover.

The slower growth isn't hesitation. It's refinement. Google drew lines on where AI belongs in healthcare search.

The Intent Interpretation

The 30 percentage point expansion from 2023 to 2025 wasn't uniform. It reflects Google's learning about healthcare search intent:

- Clinical information intent → Heavy AI treatment (symptoms, treatments, conditions)

- Local provider intent → AI removed entirely (Google reversed course)

- Sensitive health topics → AI consistently excluded (crisis, mental health)

Google is matching SERP treatment to query risk profile, not just search volume or category.

Where Google Went All-In: Clinical Content

Query Type Breakdown (December 2025)

Treatment and procedure queries now show 100% AI Overview presence — up from 45% in 2023. This represents a 55 percentage point increase.

Pain-related queries show 98% AI Overview presence — up from 58% in 2023. This represents a 40 percentage point increase.

Symptoms and conditions queries show 93% AI Overview presence — up from 57% in 2023. This represents a 36 percentage point increase.

Medical coding queries (ICD-10, CPT) show 90% AI Overview presence — up from 67% in 2023. This represents a 23 percentage point increase.

What This Means for Clinical Content

If you're measuring organic traffic on treatment pages, symptom guides, or condition explainers — and seeing declines while rankings hold steady — AI Overviews are likely the cause.

A Position 1 ranking on "rotator cuff surgery recovery" doesn't deliver the same traffic it did in 2023. The AI Overview answers the query before users reach organic results.

The Specialty Breakdown

- Google's expansion varied significantly by medical specialty. Core clinical specialties saw the highest coverage:

- Genetic/Genomic content: 97% have AI Overviews (up from 63% in 2023)

- Cardiology content: 96% have AI Overviews (up from 63% in 2023)

- Urology content: 96% have AI Overviews (up from 68% in 2023)

- Gastroenterology content: 94% have AI Overviews (up from 41% in 2023)

- Orthopedics content: 94% have AI Overviews (up from 63% in 2023)

- Neurology content: 89% have AI Overviews (up from 64% in 2023)

- Lower coverage categories include:

- Primary Care content: 74% have AI Overviews (up from 66% in 2023)

- Mental Health/Behavioral content: 63% have AI Overviews (up from 58% in 2023)

- Eating Disorders content: 63% have AI Overviews (up from 32% in 2023)

- The pattern: clinical specialties with clear diagnostic and treatment pathways saw the most aggressive expansion. Categories intersecting with sensitive topics or local intent saw more conservative treatment.

Where Google Pulled Back: The Reversal Story

Local "Near Me" Queries: 100% → 0%

This is the most significant finding in the data. Google completely reversed its approach to local healthcare searches.

- December 2023: 100% of local/provider intent queries had AI Overviews

- December 2024: 14% of local/provider intent queries had AI Overviews

- December 2025: 0% of local/provider intent queries have AI Overviews

Queries affected include searches like "dermatologist near me," "cardiologist near me," "pediatric dentist near me," and "best family doctor near me."

Google tested AI Overviews on these queries. Then removed them entirely.

Why This Matters

User-Generated Content

For healthcare practices, clinics, and hospital systems: your local SEO investment still pays off. Google has decided — at least for now — that local healthcare provider searches should be handled by traditional local results (Maps, local pack, organic listings) rather than AI summaries.

The queries that drive new patient acquisition remain traditional SEO territory.

Visual and Imaging Content: 45% → 30%

Queries seeking medical images, X-rays, or diagnostic visuals also saw Google pull back:

- December 2023: 45% had AI Overviews

- December 2025: 30% have AI Overviews

Queries like "broken ankle x-ray," "MRI results interpretation," and "skin cancer pictures" don't lend themselves to text-based AI summaries. Google recognized this and reduced coverage.

This creates an opportunity: image-rich medical content faces less AI competition than text-based clinical content.

Where Google Consistently Excludes AI

Some healthcare topics have shown zero or near-zero AI Overview presence across all three years. Google has clearly made policy decisions to keep AI out of these areas:

Consistently Excluded (0% AI Overviews)

- Self-harm and suicide-related queries

- Specific eating disorder names (anorexia, bulimia)

- Crisis intervention terminology

- Addiction-related queries

Consistently Low Coverage

- Mental health crisis terminology

- Abuse-related queries

- Visual diagnostic content

The Implication

If your content focuses on sensitive mental health topics, traditional SEO fundamentals still apply. Rankings matter. Featured snippets matter. AI isn't intercepting these users — Google has determined that human-curated results are more appropriate.

The Stability Factor: Volatility Is Over

Early 2024: High Volatility

If your content focuses on sensitive mental health topics, traditional SEO fundamentals still apply. Rankings matter. Featured snippets matter. AI isn't intercepting these users — Google has determined that human-curated results are more appropriate.

Late 2025: Stable Deployment

By late 2025, monthly volatility dropped to approximately 5 percentage points. Google has settled into a steady state.

What This Means for Planning

The wild experimentation phase is over. What you see now is Google's established approach to healthcare AI Overviews. You can plan content strategy around these patterns with reasonable confidence they'll persist.

Search Volume Analysis

AI Overview deployment in healthcare does not significantly vary by search volume:

- High volume keywords (100K+ monthly searches): 89% have AI Overviews

- Medium volume keywords (10K-100K monthly searches): 88% have AI Overviews

- Low volume keywords (1K-10K monthly searches): 89% have AI Overviews

- Very low volume keywords (under 1K monthly searches): 100% have AI Overviews

Google isn't reserving AI Overviews for high-traffic queries. Even long-tail, low-volume medical queries now predominantly feature AI-generated responses.

The decision factor isn't volume — it's query type and intent.

Technical Methodology

Data Source: BrightEdge Generative Parser™

Analysis Approach:

- Healthcare keywords analyzed at equivalent points in December 2023, December 2024, and December 2025

- AI Overview presence tracked by specialty area (L2 taxonomy) and query type

- Query intent patterns categorized by clinical, local, sensitive, and visual content types

- Stability measured by monthly variance in AI Overview deployment rates

Measurement Periods:

- December 2023 snapshot: December 22, 2023

- December 2024 snapshot: December 22, 2024

- December 2025 snapshot: December 22, 2025

- Trendline data: Daily tracking November 2023 through December 2025

All figures expressed as percentages to protect proprietary dataset composition.

Key Takeaways

- The Coverage Expansion: Healthcare AI Overview presence grew from 59% to 89% over two years — a 30 percentage point increase. Most growth occurred between 2023 and 2024.

- The Clinical Saturation: Treatment queries (100%), pain-related queries (98%), and symptom queries (93%) are now near-fully covered by AI Overviews. Clinical content is AI territory.

- The Local Reversal: "Near me" and provider-finding queries went from 100% AI Overview coverage in 2023 to 0% in 2025. Google completely reversed course on local healthcare search.

- The Sensitivity Boundaries: Self-harm, eating disorder names, crisis terms, and addiction queries remain consistently excluded from AI Overviews across all three years.

- The Specialty Pattern: Clinical specialties (Cardiology, Gastro, Ortho) show 94-97% coverage. Mental health and primary care show 63-74% coverage.

- The Stability Shift: Monthly volatility dropped from ~20 percentage points in early 2024 to ~5 percentage points in late 2025. Google's approach has stabilized.

Industry Implications:

This research confirms that Google's AI Overview strategy for healthcare has moved from experimentation to established policy. The testing phase produced clear conclusions that now govern deployment.

For healthcare marketers and SEO professionals, the implications are significant:

The landscape has bifurcated. Clinical information queries are AI territory — expect AI Overviews on nearly every symptom, treatment, or condition query. Local provider queries remain traditional SEO territory — Google removed AI entirely.

Traffic declines may not indicate content problems. If your clinical content shows declining traffic while rankings hold steady, AI Overviews — not content quality — are likely the cause. Adjust your success metrics accordingly.

Local SEO still delivers. For practices, clinics, and hospital systems focused on patient acquisition, Google Business Profile optimization and local search fundamentals still drive results. Google kept AI out of these queries.

Sensitive content follows traditional rules. Mental health crisis content, eating disorder resources, and addiction support pages compete in a traditional SERP environment. E-E-A-T signals and authoritative sourcing remain your primary levers.

Two metrics now matter. For clinical content, track AI citation presence alongside traditional rankings. For local content, traditional position tracking still tells the full story.

The system has stabilized. Unlike the volatile deployment of early 2024, Google's current approach appears settled. Plan your 2026 strategy around these patterns with confidence.

Download the Full Report

Download the full AI Search Report — Healthcare and AI Overviews: How Google Sharpened Its Approach Over Three Years

Click the button above to download the full report in PDF format.

Published on December 24, 2025