Google AI Overviews Holiday Citation Analysis: The YouTube Dominance That Changes Everything

YouTube earns nearly 3x more AI Overview citations than any other non-brand domain—reshaping who you're really competing with this holiday season.

Data Collected: Analyzed AI Overview citation patterns across major ecommerce categories to understand:

- Domain citation frequency patterns

- Category-specific citation preferences

- Multi-source citation overlap patterns

- Search volume correlation with citation sources

- Query intent patterns by domain

Key Finding: YouTube dominates third-party citations with nearly 7% coverage of all AI Overviews, appearing alongside 70% of the other top 5 cited sources. The real opportunity isn't beating competitors—it's leveraging the validation ecosystem AI Overviews already trust.

The Citation Hierarchy

Coverage Distribution

- YouTube: 6.9% of tracked keywords

- Amazon: 2.9% of tracked keywords

- Reddit: 2.4% of tracked keywords

- Wikipedia: 1.9% of tracked keywords

- Facebook: 1.2% of tracked keywords

The Overlap Pattern

Every AI Overview cites multiple sources (typically 3-5+), but the overlap patterns reveal YouTube's central role:

When Amazon gets cited:

- 72% also include YouTube

- 24% also include Reddit

- 9% also include Wikipedia

When Reddit gets cited:

- 72% also include YouTube

- 29% also include Amazon

- 8% also include Wikipedia

The Strategic Insight: YouTube acts as the validation hub—when Google cites other sources for credibility, YouTube provides the visual proof.

Category Domination Patterns

Electronics & TVs: YouTube's Kingdom

- YouTube: 78% of category citations

- Reddit: 17% of category citations

- Others: 5% combined

Example queries: "best 65 inch tv", "samsung vs lg oled", "4k tv under 1000"

Kitchen Appliances: Demonstration Drives Citations

- YouTube: 62% of category citations

- Reddit: 16% of category citations

- Amazon: 12% of category citations

Example queries: "best blender for smoothies", "vitamix vs ninja", "air fryer reviews"

Apparel & Fashion: The Authenticity Split

- YouTube: 41% of category citations

- Reddit: 39% of category citations

- Amazon: 17% of category citations

Example queries: "best running shoes", "winter coats that work", "jeans for men"

Grocery & Food: The Information Divide

- Wikipedia: 55% of category citations

- Facebook: 46% of category citations

- YouTube: 15% of category citations

Example queries: "what is quinoa", "apple varieties", "beef cuts"

The Query Intent Patterns

What YouTube Wins

- 31% contain "best" - comparison and evaluation queries

- 9% contain numbers - specific product specifications

- Average 3.2 words - detailed, specific searches

What Reddit Captures

- 28% contain "best" - authentic recommendations

- 39% are apparel - fit and quality discussions

- Average 3.4 words - long-tail specific queries

What Wikipedia Owns

- 0% contain "best" - purely informational

- 52% high-volume (>50K monthly searches)

- Average 1.8 words - broad topic queries

Search Volume Insights

High-Volume Keywords (>50K monthly)

- Wikipedia: 52% of its citations

- Facebook: 29% of its citations

- YouTube: 17% of its citations

Strategic Insight: Educational content dominates high-volume informational queries

Mid-Volume Keywords (5K-50K monthly)

- Reddit: 49% of its citations

- YouTube: 44% of its citations

- Amazon: 37% of its citations

Strategic Insight: The sweet spot for product research and evaluation

Low-Volume Keywords (<5K monthly)

- Amazon: 49% of its citations

- Reddit: 44% of its citations

- YouTube: 40% of its citations

Strategic Insight: Long-tail, specific product queries

The Multi-Source Reality

Citation Frequency

- Single source only: 50% of queries

- Two sources: 37% of queries

- Three sources: 12% of queries

- Four+ sources: 1% of queries

Unique vs. Shared Citations

- YouTube: 40% unique citations (highest standalone value)

- Wikipedia: 38% unique citations

- Facebook: 27% unique citations

- Reddit: 14% unique citations

- Amazon: 20% unique citations

Holiday Shopping Implications

November Research Phase

Based on patterns, expect:

- Increased "best" and comparison queries

- Higher YouTube citation frequency

- Multi-source validation for gift guides

December Purchase Phase

Historical patterns suggest:

- Decreased AI Overview presence

- More transactional queries

- Traditional search dominance

Strategic Implementation Framework

For Retailers

Immediate Actions:

- Audit existing YouTube presence for your products

- Identify YouTubers already reviewing your inventory

- Create comparison content for Black Friday

- Build resource pages featuring trusted reviews

Content Priorities:

- "Best [product] for [use case]" content

- Category comparison guides

- Gift guides with video embeds

- Product roundups with multiple sources

For OEMs

Immediate Actions:

- Ensure every holiday SKU has video content

- Partner with reviewers before Black Friday

- Create embeddable specification widgets

- Monitor Reddit for product feedback (intelligence only)

Content Priorities:

- Official product demonstration videos

- Feature explanation content

- Comparison within product lines

- Technical specification resources

The Code Freeze Advantage

Many brands face development freezes during the holidays, but these citation patterns reveal off-domain opportunities:

No Dev Resources Required:

- Amplify existing YouTube reviews

- Share creator content on social channels

- Build partnerships with micro-influencers

- Create curated review roundups

- Engage with comparison content

Universal Patterns Across Verticals

Content That Wins Citations

- Evaluation content ("best [product] for [use case]")

- Comparison content ("X vs Y")

- Educational content ("how to use")

- Visual demonstrations

- Authentic user discussions

Content That Doesn't Get Cited

- Pure product pages

- Promotional content

- Price-focused pages

- Single-brand content

- Traditional ad copy

Technical Methodology

Data Source: AI Catalyst by BrightEdge

Analysis Period: October-November 2024

Coverage: Tens of thousands of ecommerce queries across all major categories

Tracking: Daily citation pattern monitoring and category-specific analysis

Key Takeaways

- The 7% Rule: YouTube appears in nearly 7% of all tracked ecommerce queries, 3x more than any other non-brand domain

- The 70% Overlap: When other sources get cited, YouTube appears alongside them 70% of the time

- The Category Split: Electronics (78% YouTube) vs Grocery (55% Wikipedia) shows clear domain preferences

- The Intent Filter: "Best" queries favor YouTube/Reddit, informational queries favor Wikipedia

The Multi-Source Standard: 50% of queries cite multiple sources—optimize for complementary citations

Industry Implications: This analysis reveals Google's multi-source validation strategy for AI Overviews. Rather than relying on single authorities, the system triangulates trust through different content types—video demonstrations (YouTube), authentic discussions (Reddit), specifications (Amazon), and education (Wikipedia).

For brands preparing for holiday shopping season, the message is clear: YouTube isn't optional—it's the backbone of AI Overview citations. The winners won't be those trying to dominate every platform, but those who understand their role in the citation ecosystem and align their content accordingly.

The opportunity is now: With most brands in code freeze, those who can leverage existing video content and amplify creator reviews will win the AI Overview visibility battle this holiday season.

Download the Full Report

Download the full AI Search Report —Google AI Overviews Holiday Citation Analysis: The YouTube Dominance That Changes Everything

Click the button above to download the full report in PDF format.

Published on November 06, 2025

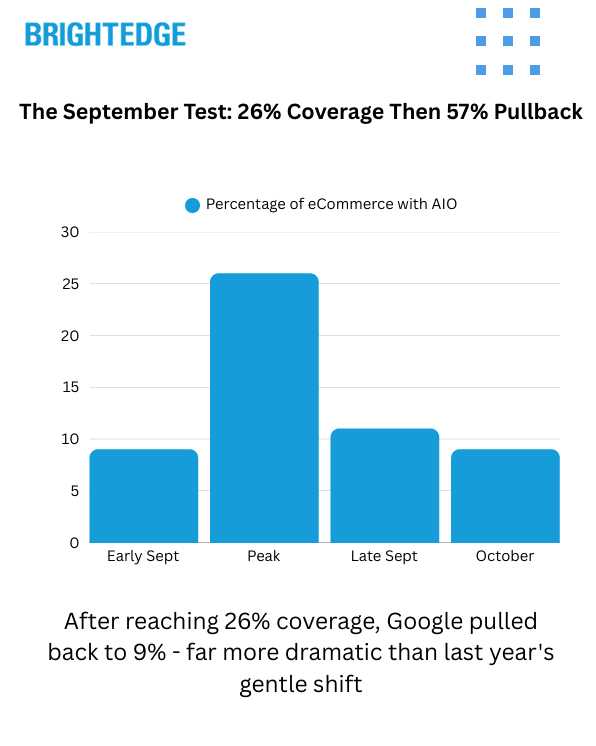

Google AI Overview Holiday Shopping Test: The 57% Pullback That Changes Everything

We tracked AI Overview across thousands of eCommerce keywords from September–October 2025. Coverage spiked from 9% to 26% on Sept 18, then pulled back to 9%—revealing Google’s holiday shopping strategy.

Data Collected: Analyzed AI Overview presence patterns across major ecommerce categories to understand:

- Daily percentage changes in AI Overview coverage

- Category-specific retention patterns

- Search volume correlation with AI Overview presence

- Year-over-year pattern changes

- Keyword intent and funnel stage analysis

Key Finding: Google retained only 30% of

AI Overviews at peak, with dramatic differences by category. Grocery maintained 56% retention while Furniture dropped to 3%—revealing a deliberate strategy to deploy AI where it adds value without disrupting commerce.

The September Spike Pattern

Coverage Timeline

- Sept 1-10: 9% baseline coverage

- Sept 11-18: Surged to 26% (peak on Sept 18)

- Sept 19-30: Rapid pullback to 11%

- Oct 1-15: Stabilized at 9%

The Magnitude Shift

- 2024: Gentle 5.6% reduction (321 → 303 keywords)

- 2025: Massive 56.8% reduction (741 → 320 keywords)

- 10x larger pullback year-over-year

The Category Hierarchy

Winners: High Retention Categories

Grocery & Food - 56% Retention

- Recipe queries maintained strong presence

- Ingredient information valued by AI

- Food preparation guidance prioritized

TV & Home Theater - 43% Retention

- Comparison content survived cuts

- "Best TV for [use case]" queries retained

- Technical specification explanations kept

Small Kitchen Appliances - 37% Retention

- "How to use" content preserved

- Product comparison queries maintained

- Feature explanation content retained

Losers: Low Retention Categories

Furniture - 3% Retention (97% removed)

- Visual shopping experience prioritized

- Traditional galleries preferred

- Limited informational value for AI

Home - 7% Retention (93% removed)

- Decorating queries removed

- Shopping-focused vertical

- Visual browsing emphasized

Apparel - 23% Retention (77% removed)

- Fashion requires visual discovery

- Size/fit better served by reviews

- Brand shopping preserved for traditional search

The Search Volume Revelation

2025's Complete Strategy Reversal

Unlike 2024, Google now retains higher-volume keywords:

- Retained keywords: 13,675 median search volume

- Removed keywords: 12,817 median search volume

- Ratio: 1.07x higher volume for retained

Volume Distribution

Removal rates were surprisingly uniform across volume quartiles:

- Q1 (Lowest): 71.5% removed

- Q2 (Med-Low): 73.1% removed

- Q3 (Med-High): 75.0% removed

- Q4 (Highest): 66.5% removed

The Intent Pattern

What Google Kept

Middle-Funnel Dominance

- 26.3% of retained keywords are evaluation/comparison queries

- "Best [product]" queries show 25% retention

- "X vs Y" comparisons maintained strong presence

Research & Learning

- "How to" queries retained where applicable

- Educational content about products preserved

- Comparison and evaluation prioritized

What Google Removed

Bottom-Funnel Purge

- Transactional keywords heavily removed

- Price-related queries eliminated

- Specific product names dropped

- "Buy" and "deals" queries removed

The Strategic Logic: AI Overviews help during research, step back during purchase

Holiday Predictions Based on Patterns

Expected November Behavior

If 2025 follows 2024's seasonal pattern:

- Current: 9% coverage

- November projection: 10-11% coverage

- Rationale: Research phase intensifies

Expected December Behavior

- December projection: 8-9% coverage

- Rationale: Purchase intent dominates

- Pattern: AI steps back for shopping season

The Opportunity Window

- November: Citation opportunities during research phase

- December: Traditional search dominates purchases

- Critical timing: Content must be ready NOW

Strategic Implementation Framework

For High-Retention Categories (>40%)

- Double down on comparison content

- Create comprehensive buying guides

- Build "best of" content for every segment

- Focus on educational material

For Medium-Retention Categories (20-40%)

- Test both AI and traditional optimization

- Monitor weekly for pattern changes

- Create topic clusters for stability

- Balance informational and transactional

For Low-Retention Categories (<20%)

- Prioritize traditional SEO tactics

- Focus on shopping feed optimization

- Invest in visual content

- Maintain product grid prominence

Universal Patterns Across Verticals

Despite category differences, certain patterns hold:

Content Types That Win

- Evaluation content ("best [product for use case]")

- Comparison content ("X vs Y")

- Educational content ("how to use")

- Higher search volume queries

Content Types That Lose

- Transactional queries

- Specific product searches

- Price-focused content

- Brand-specific queries

The 82% Reshuffling

Year-over-year keyword overlap: Only 18%

This massive reshuffling indicates:

- Google is actively experimenting

- Strategies must be flexible

- Historical performance doesn't guarantee future presence

- Monitoring is more critical than ever

Actionable Insights for SEO Professionals

Immediate Actions

- Audit your content: Identify evaluation vs transactional pages

- November priority: Get comparison content indexed NOW

- Category check: Assess your vertical's retention rate

- Volume analysis: Focus on 13K+ search volume keywords

Long-Term Strategy

- Dual approach: Win AI for research, traditional for transactions

- Content clusters: Build comprehensive topic coverage

- Monitor volatility: Weekly tracking through holidays

- Prepare for change: Only 18% YoY consistency

Technical Methodology

Data Sources:

- Daily AI Overview tracking Sept 1 - Oct 15

- Keyword-level analysis across ecommerce categories

- Search volume correlation analysis

- Category-specific retention calculations

Measurement Period: September 1 - October 15, 2024 and 2025

Analysis Tools: Manual tracking and proprietary monitoring systems

Key Takeaways

- The 57% Rule: Google pulled back 57% from peak, 10x more aggressive than 2024

- The Category Split: 56% retention (Grocery) vs 3% (Furniture) shows clear priorities

- The Volume Flip: Higher volume now retained (opposite of 2024)

- The Intent Filter: Research queries win, transactional queries lose

The 82% Shuffle: Only 18% keyword overlap year-over-year

Industry Implications:

This test reveals Google's dual strategy: Help users research with AI Overviews, preserve commercial intent for traditional results. The aggressive pullback suggests quality thresholds are higher than ever, while category-specific patterns show Google understands where AI adds vs. detracts from user experience.

For brands preparing for holiday shopping season, the message is clear: November is for research (AI Overviews), December is for buying (traditional search). Position your content accordingly.

Download the Full Report

Download the full AI Search Report — Google AI Overview Holiday Shopping Test: The 57% Pullback That Changes Everything

Click the button above to download the full report in PDF format.

Published on October 30, 2025

Google AI Overview Holiday Shopping Test: The 57% Pullback That Changes Everything

AI Search Engine Citation Volatility: The 70x Stability Gap

We tracked weekly citation shifts across ChatGPT, Perplexity, Google AI Overview, and AI Mode using BrightEdge AI Catalyst—revealing a universal law: authority drives stability, with a 70× volatility gap between frequently and rarely cited domains.

Data Collected: Analyzed citation and mention volatility patterns across four major AI platforms to understand:

- Week-over-week percentage changes in citation/mention share

- Correlation between citation frequency and volatility

- Domain type volatility patterns

- Engine-specific stability characteristics

- Market share impact on citation consistency

Key Finding: While each AI engine shows different baseline volatility (Perplexity: 72.8%, Google AIO: 41.8%), all engines stabilize around high-authority domains. Domains cited frequently experience 0.7% weekly volatility, while those cited sporadically swing 50%+—a 70x difference that holds across every platform.

The Volatility Hierarchy

Citation Volatility Rankings by Engine

AI Mode - Most volatile

ChatGPT - Moderate-high

Perplexity - Moderate baseline with extreme spikes

Google AIO - Most stable

Mention Volatility Rankings

Perplexity - Extremely volatile

AI Mode - High volatility

Google AIO - Moderate

ChatGPT - Most stable

The Frequency-Stability Law

Critical Threshold: The 50-citation mark represents the stability inflection point where volatility drops from 50% to 8%.

Market Share Impact on Stability

Universal Pattern Across Engines

Google AIO Citations:

- Dominant (>5% share): 2.8% volatility

- Major (1-5%): 6.9% volatility

- Medium (0.5-1%): 12.2% volatility

- Small (0.1-0.5%): 19.9% volatility

- Tiny (<0.1%): 42.9% volatility

ChatGPT Citations:

- Dominant (>5%): 1.4% volatility

- Major (1-5%): 4.9% volatility

- Medium (0.5-1%): 5.9% volatility

- Small (0.1-0.5%): 12.2% volatility

- Tiny (<0.1%): 50.7% volatility

The Perplexity Anomaly

Perplexity shows inverse patterns with extreme volatility for major players:

- Dominant (>5%): 1,945.7% volatility

- Major (1-5%): 1,471.6% volatility

- Tiny (<0.1%): 32.2% volatility

This suggests active algorithm experimentation affecting established domains most.

Domain Type Volatility Patterns

Most Volatile Categories

- Forums/Q&A (Reddit, Quora): 50-3,600% volatility depending on engine

- News Media: 20-1,900% volatility (highly engine-dependent)

- Blog Platforms: 25-76% average volatility

Most Stable Categories

- Government (.gov): 35-54% volatility across engines

- Educational (.edu): 45-60% volatility

- Reference Sites (Wikipedia): 18-204% volatility

Platform-Specific Stability

- YouTube: Maintains <1% volatility on Google properties

- Wikipedia: Consistent low volatility across all engines

- Mayo Clinic-type sites: Industry authority sites show universal stability

Strategic Implementation Framework

For High-Frequency Domains (0.7% volatility)

- Update content quarterly to maintain relevance

- Expand into adjacent query spaces

- Monitor for algorithm shifts that could impact position

- Leverage stability to test new content formats

For Moderate-Frequency Domains (8% volatility)

- Deepen content in existing categories

- Build comprehensive guides to cross stability threshold

- Focus on earning citations in 100+ additional queries

- Create topic clusters rather than standalone pages

For Low-Frequency Domains (50% volatility)

- Accept volatility as normal during growth phase

- Create pillar content in core expertise areas

- Focus on one topic cluster until gaining traction

- Prioritize quality over quantity to build authority

Universal Winners Across All Engines

Despite engine differences, certain content maintains stability everywhere:

- Government Resources: 35-55% more stable than average

- Educational Content: Consistent performance across platforms

- Reference-Quality Resources: The "Mayo Clinic" of each vertical

- Major Platforms: YouTube, Wikipedia maintain dominant positions

- Review Sites: 3.6-5.3% citation share universally

The "Optimize Once, Win Everywhere" Reality

The data validates a unified optimization approach:

- Authority signals transcend engine preferences

- Quality content achieves stability across all platforms

- The same fundamentals drive success everywhere

- Engine "personalities" affect initial citation, not long-term stability

Why This Works

Even Perplexity—with extreme baseline volatility—stabilizes around frequently-cited sources. AI Mode shows 62.4% average volatility, yet high-authority domains maintain sub-10% volatility across ALL engines.

Actionable Insights for SEO Professionals

Immediate Actions

- Monitor Weekly Volatility: Track citation patterns to understand current stability level

- Identify Industry Authorities: Find and partner with your vertical's "Mayo Clinics"

- Leverage Trust Signals: Create YouTube videos and educational content

- Build Topic Clusters: Comprehensive coverage reduces volatility faster

Long-Term Strategy

- Prioritize Frequency Over Recency: Being cited often matters more than being cited recently

- Accept Initial Volatility: New domains should expect 30-50% weekly swings

- Focus on Threshold Crossing: Aim for 50+ citations as minimum viable stability

- Diversify Content Types: Mix formats that perform well across engines

Technical Methodology

Data Sources:

- Hundreds of Thousands of citation records across all engines

- Hundreds of Thousands of mention records across all engines

- Week-over-week percentage changes in citation/mention share

- Correlation analysis between frequency, market share, and volatility

Measurement Period: Ongoing tracking with weekly volatility calculations

Analysis Tools: BrightEdge AI Catalyst for comprehensive citation tracking

Key Takeaways

- The 70x Rule: High-frequency citations are 70x more stable than low-frequency

- The 50-Citation Threshold: Minimum target for achieving stability

- Perplexity's Paradox: Major players face MORE volatility than smaller ones

- Google's Stability Premium: Most predictable citation patterns

- Universal Authority: Quality content stabilizes across all engines

Industry Implications:

The stability patterns reveal that AI search optimization doesn't require platform-specific strategies. Instead, building authoritative, comprehensive content creates stability across all engines. This "optimize once, win everywhere" approach simplifies AI SEO while maximizing return on content investment.

For brands tracking citations with BrightEdge AI Catalyst, focus monitoring efforts on high-volatility engines (Perplexity, AI Mode) while maintaining quarterly reviews for stable performers (Google AIO, ChatGPT).

Download the Full Report

Download the full AI Search Report — AI Search Engine Citation Volatility: The 70x Stability Gap

Click the button above to download the full report in PDF format.

Published on October 23, 2025

AI Search Engine Citation Volatility: The 70x Stability Gap

How Different AI Search Engines Choose Which Brands to Recommend

We analyzed tens of thousands of prompts across ChatGPT, Perplexity, and Google’s AI systems using BrightEdge AI Catalyst—revealing key differences in how each AI cites and prioritizes brands, with major implications for marketers in 2025 and beyond.

Data Collected: Monitored brand mention and citation patterns across four major AI platforms using BrightEdge AI Catalyst to analyze:

- Brand mention rates by engine and industry

- Citation source preferences and domain diversity

- Prompt patterns that trigger brand visibility

- Industry-specific behavioral differences

- Holiday and seasonal query performance

Key Finding: Each AI engine has a distinct "personality" that determines brand visibility. ChatGPT mentions brands in 99.3% of eCommerce responses while Google AI Overview includes them in just 6.2%. These aren't random variations—they're fundamental design differences that shape how customers discover products.

The Big Numbers

- 99.3% of ChatGPT eCommerce responses include brands

- 6.2% of Google AI Overview responses mention brands

- 41.3% of ChatGPT citations go to retail/marketplace domains

- 62.4% of Google AI Overview citations go to YouTube

- 8,027 unique domains cited by Perplexity (most diverse)

- 2,127 unique domains cited by ChatGPT (most concentrated)

Brand Mention Patterns by Engine

The Brand Maximizer: ChatGPT

- 5.84 average brands per eCommerce response

- 99.3% of responses include brand mentions

- 24 maximum brands in a single response

- Heavily favors established retail giants

- Amazon appears in 61.3% of citations

The Minimalist: Google AI Overview

- 0.29 average brands per eCommerce response

- 6.2% of responses include any brands

- 19 maximum brands in a single response

- Appears alongside organic results that handle commercial intent

- Prioritizes educational content over brand listings

The Balanced Performer: Google AI Mode

- 5.44 average brands per eCommerce response

- 81.7% of responses include brands

- 30 maximum brands in a single response

- Strong preference for brand/OEM sites (15.2% of citations)

- Balances commercial and informational content

The Citation Champion: Perplexity

- 4.37 average brands per eCommerce response

- 85.7% of responses include brands

- 45 maximum brands in a single response

- 8.79 average citations per response (highest)

- Most diverse source pool with 8,027 unique domains

Domain Citation Patterns

Where Each Engine Gets Its Information

Retailer/Marketplace Dominance:

- ChatGPT: 41.3% (Amazon, Target, Walmart lead)

- Perplexity: 21.2% (more balanced distribution)

- Google AI Mode: 14.5%

- Google AI Overview: 4.7%

Social/Community Reliance:

- Google AI Overview: 12.3% (YouTube 62.4%, Reddit 25.4%)

- Google AI Mode: 4.6%

- Perplexity: 4.6%

- ChatGPT: 0.4% (almost never cites social)

Brand/OEM Sites:

- Google AI Mode: 15.2% (highest brand site preference)

- ChatGPT: 5.5%

- Perplexity: 4.1%

- Google AI Overview: 2.6%

The "Other" Category: 48-77% of citations come from specialized sites beyond major platforms—industry publications, niche experts, and topic-specific resources. This long tail represents significant opportunity for specialized content creators.

Winning Prompt Patterns

Keywords That Trigger Maximum Brand Mentions

- "Budget/Affordable/Cheap" → 6.3-8.8 brands per response

- "Best/Top" rankings → 4.7-6.2 brands per response

- "Deals/Sales/Discount" → 6.2-8.3 brands per response

- "Buy/Shop/Purchase" → 5.8-7.8 brands per response

- "Compare/vs/versus" → 4.5-5.8 brands per response

Holiday Performance Boost

- Holiday-specific prompts generate 12% more brand mentions

- Gift queries average 6.5 brands vs 5.8 for general queries

- Perplexity delivers 9.4 citations for holiday searches

- Deal/discount queries see the highest brand density

Industry Variations

While our analysis focused on eCommerce, the behavioral patterns persist across industries:

- B2B Tech: High brand mentions for software comparisons

- Healthcare: Conservative brand mentions, higher citation requirements

- Finance: Institution names and product brands prominent

- Restaurants: Chain brands dominate mentions

- Travel: Hotels, airlines, booking platforms as primary brands

Strategic Takeaways

Understanding Engine Behaviors

ChatGPT treats most commercial queries as requiring comprehensive brand options. It prioritizes being helpful through extensive listings rather than selective recommendations.

Google AI Overview intentionally minimizes commercial content, relying on organic results for transactions while using AI for educational guidance.

Perplexity balances brand mentions with extensive source citations, appealing to research-oriented users who value transparency.

Google AI Mode strikes a middle ground, providing substantial brand information while maintaining source credibility.

The Market Context

While Google maintains 90% of search market share, these emerging AI engines influence high-value customers during research phases. ChatGPT and Perplexity users often represent early adopters and decision-makers who turn to AI for comprehensive analysis rather than simple searches.

Optimization Priorities

- Don't pick favorites - Optimize for all engines with a unified strategy

- Ensure retail presence - Major marketplaces are crucial for ChatGPT visibility

- Build authority content - Perplexity rewards comprehensive, citable resources

- Leverage video - YouTube dominates Google AI Overview citations

- Target trigger keywords - "Budget," "best," and comparison terms guarantee mentions

- Monitor the long tail - 48-77% of citations come from specialized sites

The 2025 Opportunity

The data reveals clear patterns: certain keywords trigger predictable brand mention rates, specific content types earn more citations, and each engine has distinct preferences. Brands that understand these patterns can optimize once but win everywhere—ensuring visibility regardless of which AI engine customers choose.

The surprise finding? Review sites perform equally across all engines (3.6-5.3% of citations), suggesting this content type transcends individual engine preferences. Meanwhile, most brands haven't yet adapted to these behavioral differences, creating significant first-mover advantage for those who act now.

.png)

Strategic Insight:

These aren't competing platforms requiring separate strategies—they're complementary channels that serve different user intents. ChatGPT provides comprehensive options, Google AI Overview offers educational context, Perplexity delivers researched recommendations, and Google AI Mode balances both needs. Success means ensuring your brand appears in the formats each engine trusts: retail feeds for ChatGPT, YouTube content for Google AI Overview, authoritative guides for Perplexity, and strong brand sites for Google AI Mode.

Monitor your performance across all engines using AI Catalyst, optimize for high-impact keywords in your industry, and remember—with holiday shopping approaching, the brands that understand these patterns will capture disproportionate visibility in AI-driven purchase decisions.

Download the Full Report

Download the full AI Search Report —How Different AI Search Engines Choose Which Brands to Recommend

Click the button above to download the full report in PDF format.

Published on October 17, 2025

How Different AI Search Engines Choose Which Brands to Recommend

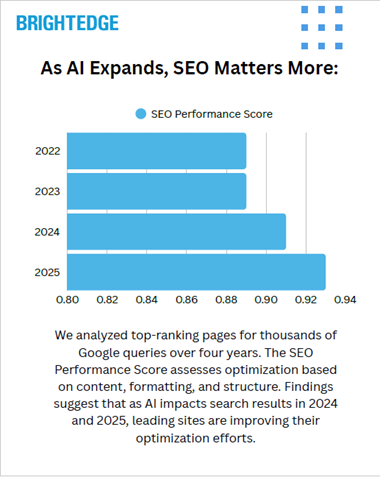

AI Didn't Kill SEO—It Made Excellence in Fundamentals More Important Than Ever

We tracked tens of thousands of keywords from 2022-2025. The data reveals that top-ranking pages aren't abandoning SEO—they're executing it better than ever before.

Data Collected:

Tracked performance metrics for tens of thousands of keywords from 2022–2025 using BrightEdge SearchIQ to analyze how top-ranking pages evolved across:

- On-page optimization

- Schema implementation

- Technical performance

Key Finding:

Top-ranking pages doubled schema usage when ChatGPT launched, improved performance scores by 20% despite pages becoming 43% heavier, and achieved 97% schema adoption by 2025—proving SEO fundamentals matter more than ever in the AI era.

The Big Numbers

- 97% of top results now use schema markup (up from 93%)

- 2X increase in structured data usage (9.6 → 18.5 schemas per SERP)

- 20% improvement in performance scores

- 50% faster interactivity (FID)

- 32% improvement in server response times

The Evolution Timeline

2022: The Baseline

- Pre-ChatGPT era

- Avg. 9.6 schemas per SERP

- SEO Score: 0.89

- Performance Score: 0.426

2023: The Explosion

- ChatGPT goes mainstream (Nov 2022)

- Schema usage nearly doubles overnight

- First signs of content evolution

2024: The Refinement

- Google AI Overviews launch (May)

- Technical optimization accelerates

2025: The New Normal

- 97% schema adoption

- SEO Score: 0.92

- Performance Score: 0.512

Takeaways from Data

- Structured Data Became Non-Negotiable

When ChatGPT launched in late 2022, schema markup usage nearly doubled within months. Top pages now average 17+ schema types vs. just 9 in 2022. This isn’t coincidence—it’s adaptation. - Technical Excellence Drives Rankings

Despite pages becoming 43% heavier, performance scores improved 20%. Server response times improved 32%, interactivity improved 50%, and Core Web Vitals became a competitive differentiator. - Quality Beats Quantity

Content got 13% shorter while SEO scores improved. Pages grew 18% larger in file size while reducing word count. The message: focused, structured, technically excellent content outperforms long-form keyword stuffing.

Download the Full Report

Download the full report — complete data, benchmarks, and insights to guide your AI search strategy.

Click the button above to download the full report in PDF format.

Published on September 04, 2025

AI Didn't Kill SEO—It Made Excellence in Fundamentals More Important Than Ever

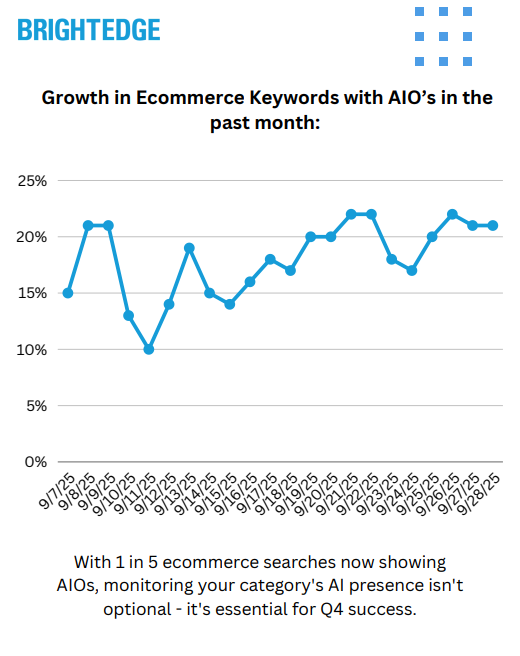

AI Overviews Just Grew 43.6% in Ecommerce Searches—Your Holiday Strategy Needs Both AI and Organic Tactics

We analyzed how Google's AI Overviews expanded across ecommerce searches during September using BrightEdge Generative Parser™. The 43.6% surge wasn't random—it reveals Google's strategic deployment ahead of the critical holiday shopping season.

Data Collected: Monitored AI Overview presence across ecommerce keywords from September 7-30, 2025 using BrightEdge Generative Parser™ to analyze:

Coverage changes by category

Query type patterns

Search volume distribution

Category-level deployment strategies

Key Finding: AI Overview presence jumped from 14.4% to 20.7% of ecommerce queries in just 23 days—but the expansion targeted specific product queries while leaving comparison and review content untouched, creating distinct optimization paths for different content types.

The Big Numbers

43.6% growth in AI Overview presence (Sept 7-30)

20.7% of ecommerce searches now show AI Overviews (up from 14.4%)

32% of new AI Overviews concentrated in Home products

0% new AI Overview coverage for review keywords

2.8 words average query length for new AI Overviews

The Category Breakdown

Where AI Overviews Are Expanding

Home Products

32% of all new AI Overview expansion

Focus on appliances and comfort items

High gift potential for Q4

Apparel

28% of new AI Overview coverage

Specific clothing items vs. categories

Mid-volume search terms dominate

Small Kitchen Appliances

13% of expansion

Air fryers leading coverage

Perfect timing for holiday gifting

Electronics

High-value products like iPhone 13

Specific model searches vs. category terms

Gift-worthy items prioritized

Where Traditional Organic Still Dominates

Review Content

0% new AI Overview deployment

Complete preservation of organic results

Safe territory for investment

Comparison Queries

"X vs Y" searches remain organic-only

No AI Overview growth detected

Traditional SEO tactics still win

"Best Of" Content

94% remain without AI Overviews

Buying guides stay in organic results

Minimal disruption risk

Query Patterns That Trigger AI Overviews

High AI Overview Presence

Product-Specific Searches

"What are good air fryers"

"What is the latest iPhone"

Direct product information queries

79% of all new AI Overviews

Mid-Volume Keywords

10K-100K monthly searches

Sweet spot for AI deployment

Lower competition than head terms

Higher intent than long-tail

Short Product Queries

Average 2.8 words

Not long-tail, not head terms

Specific but accessible

Natural language patterns

Low/No AI Overview Presence

High-Volume Head Terms

Category-level searches

Minimal AI Overview coverage

Traditional SEO battleground

Preserved for organic competition

Review-Focused Queries

"[Product] reviews"

User opinion searches

100% organic results

No AI interference

Comparison Content

Versus queries

Alternative searches

Evaluation intent

Pure organic territory

Takeaways from Data

Google's Surgical Deployment: The 43.6% growth isn't universal—it's concentrated in gift-worthy categories (Home, Apparel, Electronics) while completely avoiding review and comparison content.

Two-Track Optimization Required: Product pages need AI Overview optimization while comparison/review content should focus on traditional organic rankings—they're not competing for the same visibility.

Mid-Tail Opportunity: Google favors 10K-100K search volume keywords with 2-3 word queries—not head terms or long-tail. This sweet spot represents the best ROI for AI Overview optimization.

Review Content Safe Haven: With 0% new AI Overview coverage on review keywords and comparison queries, these content types remain pure organic plays—invest confidently without AI disruption concerns.

Holiday Timing Not Coincidental: The September surge in gift categories (appliances, electronics, apparel) signals Google's preparation for holiday shopping queries. Brands need visibility strategies for both AI and organic formats.

Strategic Insight:

Your ecommerce holiday strategy doesn't need an overhaul, but it does need awareness. With 1 in 5 ecommerce searches now showing AI Overviews, understanding where they appear—and where they don't—becomes critical for Q4 success.

The data reveals Google is creating specialized lanes: AI Overviews for quick product information, traditional organic for research and evaluation. Brands that recognize this division can optimize accordingly rather than applying blanket strategies.

Monitor your product pages for AI Overview presence, protect your comparison content's organic rankings, and remember—the SERP isn't becoming simpler, it's giving you more inroads to reach your customers.

Download the Full Report

Download the full AI Search Report — AI Overviews Just Grew 43.6% in Ecommerce Searches—Your Holiday Strategy Needs Both AI and Organic Tactics

Click the button above to download the full report in PDF format.

Published on October 2, 2025

AI Overviews Just Grew 43.6% in Ecommerce Searches—Your Holiday Strategy Needs Both AI and Organic Tactics

Google's AI Overview Rollout Reveals Clear Intent Hierarchy—Here's What Gets Coverage and What Doesn't

We tracked AI Overview deployment across 9 industries for 16 months. The data reveals Google's strategic pattern: prioritizing informational queries while protecting commercial intent.

Data Collected: Monitored AI Overview coverage across 9 industries from May 2024-September 2025 using BrightEdge Generative Parser™ to analyze:

- Industry adoption rates

- Query intent patterns

- Subcategory performance

- Rollout phases

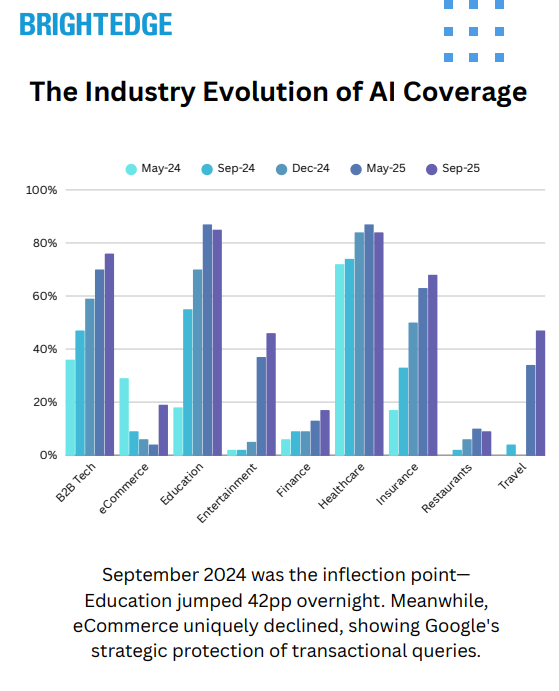

Key Finding: AI Overview coverage grew from 26.6% to 44.4% overall, but the real story is the intent hierarchy—Healthcare hits 83.6% with informational queries while eCommerce declined to 18.5% as Google protects transactional searches.

The Big Numbers

- 44.4% of queries now show AI Overviews (up from 26.6%)

- 5.5X growth in Education (15.4% → 85.2%)

- 100% AI Overview adoption in technical subcategories

- -8.7pp decline in eCommerce (only declining industry)

- <20% coverage for Finance & Restaurants

The Rollout Timeline

May 2024: Strategic Launch

- Healthcare leads at 67.6%

- B2B Tech at 34.2%

- eCommerce at 27.2%

- Focus on high-trust informational queries

September 2024: Public Rollout

- Education explodes (+42pp overnight)

- Insurance surges (+22pp)

- eCommerce drops to 8.8%

- Clear pivot to educational content

December 2024: Expansion

- Travel accelerates (8.1% → 36.9%)

- Healthcare reaches 84.2%

- Commercial queries remain suppressed

September 2025: Current State

- Education dominates at 85.2%

- Entertainment emerges at 45.9%

- eCommerce rebounds slightly to 18.5%

- Finance still minimal at 17.9%

The Intent Hierarchy

High Coverage (60-85%)

- "What is/How does" queries

- Medical definitions & symptoms

- Technical documentation

- Educational concepts

- Research comparisons (non-transactional)

Low Coverage (<20%)

- "Buy X online" queries

- Local commercial searches

- Financial advice

- Direct brand navigation

- Pure transactional intent

Takeaways from Data

- Google Protects Commercial Revenue eCommerce's decline from 27.2% to 18.5% reveals Google's strategy—AI Overviews appear where they add value without threatening ad revenue. Transactional queries remain in traditional SERP format.

- Specialized Knowledge Wins Subcategories with 100% adoption (CI/CD, Security Management, Ophthalmology) share three traits: high informational value, low commercial intent, and specialized expertise required.

- Industry Patterns Predict Opportunity Three clear patterns emerged:

- Early Adopters (Healthcare, B2B Tech): Started strong, steady growth

- Transformation Stories (Education, Insurance): Explosive growth after public rollout

- Late Bloomers (Entertainment, Travel): Minimal start, recent acceleration

- The September 2024 Inflection Public rollout triggered massive shifts—Education jumped 42pp overnight. This marks when Google found its sweet spot: high-value informational content with zero ad conflict.

Download the Full Report

Download the full report — complete industry data, rollout benchmarks, and insights to guide your AI Overview strategy.

Click the button above to download the full report in PDF format.

Published on September 11, 2025

Google's AI Overview Rollout Reveals Clear Intent Hierarchy—Here's What Gets Coverage and What Doesn't

LinkedIn Learning and Pulse Articles Emerge as Top AI Citation Sources for B2B Content

We analyzed how AI engines cite LinkedIn content across ChatGPT, Google AI Overview, and Perplexity using BrightEdge AI Catalyst. The results reveal a massive 2026 opportunity for B2B marketers who understand which LinkedIn formats AI engines trust.

Data Collected: Monitored LinkedIn content performance across major AI platforms using BrightEdge AI Catalyst to analyze:

Citation rates by content type

Platform-specific preferences

Week-over-week growth patterns

Content format effectiveness

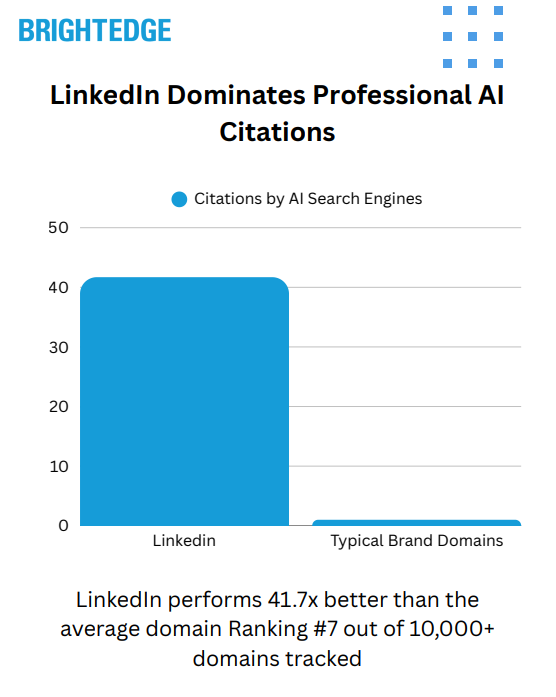

Key Finding: LinkedIn performs 41.7x better than the average domain for AI citations—yet 98% of LinkedIn content gets zero AI visibility. The 2% that breaks through follows strict patterns: LinkedIn Learning courses and educational Pulse articles dominate, while social posts, company updates, and thought leadership are completely ignored.

The Big Numbers

41.7x better performance than average domain

100% week-over-week growth in Pulse article citations

9x more LinkedIn citations on Google AI vs ChatGPT

0% citations for company posts and status updates

2% of LinkedIn content actually gets cited by AI

The Content Type Breakdown

Where LinkedIn Gets AI Citations

LinkedIn Learning

Highest performing content type across all platforms

Preferred by ChatGPT for educational queries

Curated, trusted educational resource

Evergreen visibility that compounds

Pulse "How-To" Articles

Growing 100% week-over-week

Dominates Google AI Overview citations

Financial and professional guides perform best

Educational format critical for success

Where LinkedIn Gets ZERO Citations

Social Content

Company page posts

Personal status updates

Employee spotlights

Event recaps

Engagement Content

Thought leadership posts

Industry hot takes

Poll questions

Viral content attempts

Promotional Content

Product announcements

Partnership news

"We're hiring" posts

Award celebrations

AI Platform Preferences for LinkedIn

High LinkedIn Citation Platforms

Google AI Overview

9x more citations than ChatGPT

Strong preference for Pulse articles

Emerging focus on Advice/Q&A content

Delivers majority of LinkedIn's AI visibility

ChatGPT

Prefers LinkedIn Learning courses

Main domain citations

Ignores Pulse articles

Educational content focus

Low LinkedIn Citation Platforms

Perplexity

Ultra-selective approach

Only 1.6% of LinkedIn URLs cited

Specific how-to content preference

Minimal overall presence

Google AI Mode

Near-zero LinkedIn citations

0.06% success rate

Not a priority for optimization

Focus efforts elsewhere

Query Patterns That Surface LinkedIn

High LinkedIn Visibility Queries

"How to choose a financial advisor"

Professional development paths

Career transition strategies

B2B marketing techniques

Business strategy frameworks

Industry-specific tutorials

Technical skill training

Leadership development

Zero LinkedIn Visibility Queries

Consumer product searches

Entertainment content

Health and medical queries

Recipe and cooking content

Local business searches

Weather and news

General how-to (non-professional)

Shopping comparisons

Takeaways from Data

LinkedIn Learning's Hidden Value: While becoming an instructor requires significant effort—application, collaboration, scripted content—the ROI is substantial. Your course joins LinkedIn's most AI-visible content category with guaranteed placement and payment.

The Pulse Article Formula: Only educational, guide-style Pulse articles get citations. The 100% weekly growth suggests early movers in 2026 could establish lasting advantages. Focus on "how-to" formats over thought leadership.

Platform Strategy Matters: Google AI Overview delivers the vast majority of LinkedIn citations. Optimize for Google's preferences (Pulse articles) while maintaining LinkedIn Learning content for ChatGPT visibility.

Social Content's AI Invisibility: Traditional LinkedIn engagement tactics—posts, updates, viral content—are completely invisible to AI engines. This doesn't mean abandon them, but recognize they serve different purposes than AI discovery.

The 2026 Opportunity: With explosive weekly growth and clear content preferences emerging, B2B marketers who adapt their LinkedIn strategy for AI visibility could capture significant competitive advantage.

Strategic Insight:

Your LinkedIn strategy doesn't need an overhaul, but it needs evolution. While your current content drives engagement and community, adding AI-optimized formats establishes your brand as an authoritative source that answer engines trust.

The data reveals LinkedIn has secured its position as a top-tier source for professional content—ranking among the top domains tracked. But success requires understanding that AI engines treat LinkedIn as a professional knowledge library, not a social network.

Monitor your LinkedIn content performance in AI Catalyst, test educational formats alongside your regular content, and remember—early movers in this rapidly growing space could establish lasting visibility advantages.

Download the Full Report

Download the full AI Search Report — LinkedIn Learning vs Pulse: Which Content Gets AI Citations Across Major AI Engines

Click the button above to download the full report in PDF format.

Published on October 9, 2025