Finance and AI Overviews: How Google Applies YMYL Principles to Financial Search

Last week we covered Healthcare; this week we focus on Finance (YMYL). We analyzed finance keywords across three years. Google applies similar rules, adapted to financial searches.

Data Collected

We analyzed finance keywords at the same point each December across three years to understand:

- Year-over-year changes in AI Overview deployment rates

- Query type patterns (educational vs. transactional vs. real-time data)

- Category-level expansion patterns within finance

- Comparisons to Healthcare AI Overview deployment

Key Finding

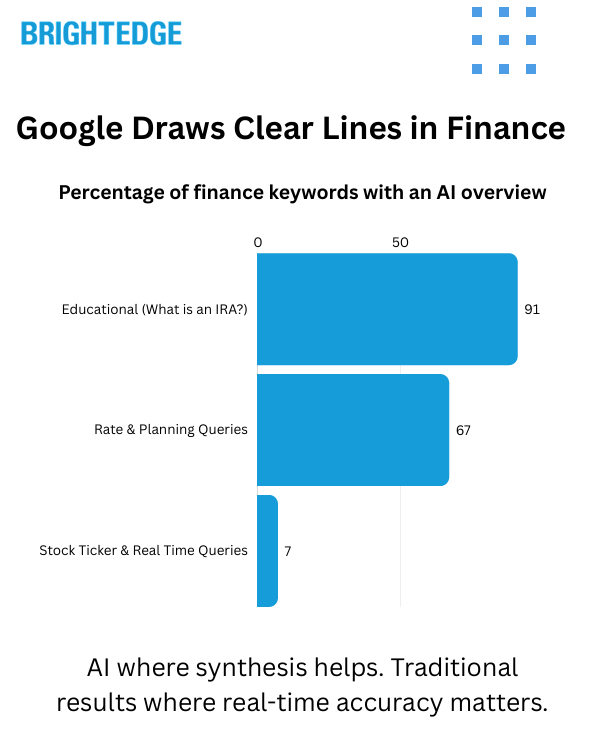

Google draws clear lines in Finance. AI Overview treatment depends entirely on query type: educational queries like "what is an IRA" hit 91% coverage — nearly identical to Healthcare. But real-time price queries like stock tickers sit at just 7%. And just like Healthcare, Google pulled back from local "near me" queries entirely. Same YMYL principles, adapted to different search behaviors.

Google Draws Clear Lines in FinanceGoogle Draws Clear Lines in Finance

AI Treatment Depends on Query Type

Unlike Healthcare's broad 89% coverage across clinical content, Finance shows distinct zones based on what users are trying to accomplish:

- Educational queries ("what is an IRA"): 91% have AI Overviews

- Rate and planning queries: 67% have AI Overviews

- Stock tickers and real-time prices: 7% have AI Overviews

Google uses AI where synthesis adds value — explaining concepts, comparing options, guiding decisions. For live market data where real-time accuracy matters, Google keeps AI out entirely.

The Real-Time Data Decision

Stock ticker queries represent a deliberate exclusion. Queries like "AAPL stock," "Tesla price," and "Microsoft share price" request real-time price data, not information synthesis.

Google's treatment has been consistent:

- December 2023: 5% had AI Overviews

- December 2024: 4% had AI Overviews

- December 2025: 7% have AI Overviews

This isn't a gap Google is trying to close — it's a line they've drawn. Real-time accuracy matters more than AI synthesis for price lookups.

Where Finance Matches Healthcare

Educational Content Gets the Same Treatment

Google treats educational queries nearly identically across both YMYL industries:

- Finance "what is" queries: 91% have AI Overviews

- Healthcare "what is" queries: 95% have AI Overviews

Examples of finance educational queries with AI Overviews:

- "what is an IRA"

- "how does compound interest work"

- "what is dollar cost averaging"

- "what is a derivative"

- "ebitda meaning"

- "what is a bond"

Planning and Guidance Content

Queries seeking financial planning guidance show similar patterns to healthcare treatment queries:

- Retirement planning queries: 61% have AI Overviews

- Rate information queries: 67% have AI Overviews

- Tax-related queries: 55% have AI Overviews

Examples include "rmd table," "capital gains tax rate," "traditional ira vs roth ira," and "what is long term care insurance."

The Local Pullback — Same Story as Healthcare

Google Removed AI From Local Finance Queries

Last week's biggest Healthcare finding: Google pulled AI Overviews from "near me" queries entirely, dropping from 100% coverage in 2023 to 0% in 2025.

Finance shows the same pattern:

- December 2023 (SGE Labs): 90% of local finance queries had AI Overviews

- December 2024: 0% of local finance queries had AI Overviews

- December 2025: ~10% of local finance queries have AI Overviews

The only local query retaining AI coverage is "tap to pay atm near me" — which is more educational about the feature than truly local intent.

Queries Google Removed AI From

- "Chase bank near me" — NO AIO

- "Wells Fargo near me" — NO AIO

- "Bank of America financial center near me" — NO AIO

- "Financial advisors near me" — NO AIO

- "ATM near me" — NO AIO

- "Moneygram near me" — NO AIO

- "Edward Jones near me" — NO AIO

The Implication

Google tested AI on local queries in both Healthcare and Finance during the SGE Labs period. After broader rollout, they pulled back from both. For "near me" queries, it's all about local pack and maps presence — no AI layer to compete with.

Where AI Is Expanding Fast

Post-Google I/O Growth Trajectory

The SGE-to-AIO transition in May 2024 reset the baseline. Since then, Finance educational and planning content has expanded rapidly.

Post-Google I/O growth (June 2024 → December 2025):

- Educational queries: 70% → 91% (+21 percentage points)

- Fixed income (bonds, CDs, treasury bills): 28% → 72% (+44 percentage points)

- Rate information (mortgage rates, HELOC rates): 26% → 67% (+41 percentage points)

- Tax questions: 0% → 55% (+55 percentage points)

Category Examples

Educational queries include "what is an IRA," "what is dollar cost averaging," "how does compound interest work," and "ebitda meaning."

Fixed income queries include "what is a bond," "treasury bill rates," "cd rates," and "fixed income investments."

Rate information queries include "interest rates today," "current mortgage rates," "heloc rates," "money market rates," and "home equity loan rates."

Tax queries include "capital gains tax rate," "federal tax brackets," and "tax free municipal bonds."

What This Growth Means

If you rank for educational finance content — retirement planning guides, tax explainers, investment education — you're now competing for citations, not just clicks. Traffic may decline even if rankings hold steady, because AI is answering these queries directly.

What Google Keeps AI Out Of

Google has drawn clear lines around query types where AI Overviews don't appear:

Real-Time Price Data

- Individual stock tickers: 7% have AI Overviews

- Market indices: Low AI coverage

- Live price queries: Traditional results dominate

Examples: "AAPL stock," "Tesla price," "dow jones industrial average today," "S&P 500 futures"

Google recognizes that real-time accuracy matters more than AI synthesis for price lookups. These high-volume queries still play by traditional ranking rules.

Local Services

- "Chase bank near me" — NO AIO

- "Wells Fargo near me" — NO AIO

- "Financial advisors near me" — NO AIO

- "ATM near me" — NO AIO

Google determined that local pack results and Maps integrations serve users better than AI summaries for finding bank branches, ATMs, and financial advisors.

Calculator and Tool Queries

- Finance calculator queries: 9% have AI Overviews

- Examples without AI: "401k calculator," "mortgage calculator," "investment calculator," "compound interest calculator"

Users want interactive tools, not AI explanations. Google serves the tools directly.

Brand and Login Queries

- Brand login queries: 0-4% have AI Overviews

- Examples: "fidelity login," "charles schwab login," "td ameritrade login," "robinhood"

Navigational queries go straight to the destination — no AI summary needed.

Finance vs Healthcare: Side-by-Side Comparison

||Healthcare|Finance|

|Educational Query AIO Rate|95%|91%|

|Local "Near Me" AIO Rate|0%|~10%|

|Real-Time Data AIO Rate|N/A|7% (tickers)|

|Overall Trajectory|Near saturation (89%)|Rapid expansion|

|YoY Growth (2024→2025)|+4.6pp|Growing fast in educational categories|

The pattern is consistent: Google uses AI where synthesis adds value (education, explanation, planning) and keeps AI out where real-time accuracy or local relevance matters (live prices, market data, "near me" searches).

Technical Methodology

Data Source: BrightEdge Generative Parser™

Analysis Approach:

- Finance keywords analyzed at equivalent points in December 2023, December 2024, and December 2025

- AI Overview presence tracked by category (L1/L2 taxonomy) and query type

- Query types segmented: educational, rate/planning, real-time/transactional, local intent

- Local intent queries identified and tracked separately

- Trendline data analyzed for post-I/O growth trajectory

Measurement Periods:

- December 2023 snapshot: December 29, 2023

- December 2024 snapshot: December 29, 2024

- December 2025 snapshot: December 26, 2025

- Trendline data: Daily tracking November 2023 through December 2025

Key Takeaways

- Google Draws Clear Lines: AI treatment in Finance depends entirely on query type — 91% for educational, 67% for rates/planning, 7% for stock tickers.

- Educational Content Matches Healthcare: "What is" queries hit 91% AI Overview coverage in Finance — nearly identical to Healthcare's 95%.

- Real-Time Data Stays Out: Stock tickers, market indices, and live price queries sit at 7% AI coverage. Google keeps AI out where real-time accuracy matters.

- Local Pullback Confirmed: Google removed AI from "near me" finance queries just like Healthcare. Bank branches, ATMs, and financial advisors "near me" show minimal AI coverage.

- Rapid Expansion Underway: Educational and planning categories grew 20-55 percentage points in one year. Tax, fixed income, and rate queries are expanding fast.

- Same Principles, Different Application: Both YMYL industries show identical patterns — AI for education, traditional results for local and real-time data.

Industry Implications:

This research confirms that Google applies consistent YMYL principles across industries while adapting to category-specific search behaviors.

For financial services marketers, the implications are significant:

Educational content = New metrics. Retirement planning guides, tax explainers, investment education, "what is" content — expect AI Overviews on most of these queries. If traffic declined while rankings held steady, AI — not your content — is likely the cause. Track citations, not just clicks.

Real-time data = Traditional rankings. Stock prices, market indices, ticker lookups — Google keeps AI out. These high-volume queries still play by traditional ranking rules. Position tracking tells the full story here.

Local "near me" = Maps territory. Bank branches, ATMs, financial advisors — no AI layer to compete with. Google Business Profile optimization and local pack presence drive these results.

The expansion continues. Unlike Healthcare (near saturation at 89%), Finance educational content is still growing rapidly. Categories at 55-70% today could reach 80-90% by late 2026. Plan your measurement strategy accordingly.

Two metrics now matter. For educational and planning content, track AI citation presence alongside traditional rankings. For real-time and local queries, traditional position tracking still tells the full story.

Same strategy, different emphasis. Quality content and technical SEO excellence work across both AI and traditional results. Understanding WHERE your visibility lives helps you measure success correctly and allocate resources appropriately.

Download the Full Report

Download the full AI Search Report —Finance and AI Overviews: How Google Applies YMYL Principles to Financial Search

Click the button above to download the full report in PDF format.

Published on January 03, 2026