Google's AI Overview Rollout Reveals Clear Intent Hierarchy—Here's What Gets Coverage and What Doesn't

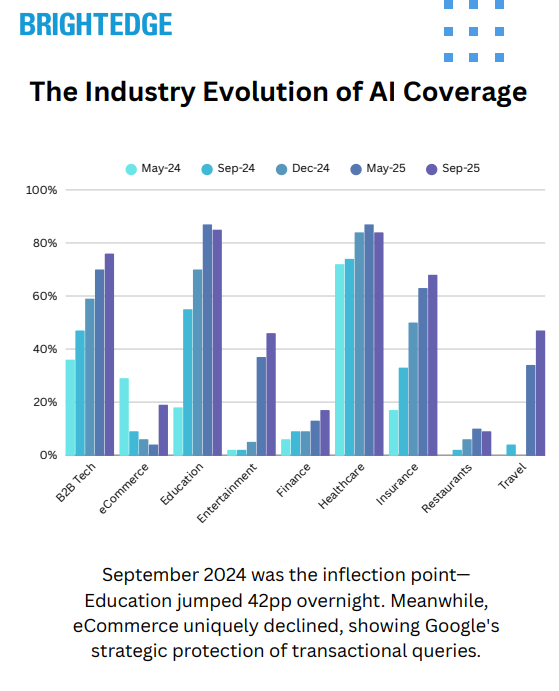

We tracked AI Overview deployment across 9 industries for 16 months. The data reveals Google's strategic pattern: prioritizing informational queries while protecting commercial intent.

Data Collected: Monitored AI Overview coverage across 9 industries from May 2024-September 2025 using BrightEdge Generative Parser™ to analyze:

- Industry adoption rates

- Query intent patterns

- Subcategory performance

- Rollout phases

Key Finding: AI Overview coverage grew from 26.6% to 44.4% overall, but the real story is the intent hierarchy—Healthcare hits 83.6% with informational queries while eCommerce declined to 18.5% as Google protects transactional searches.

The Big Numbers

- 44.4% of queries now show AI Overviews (up from 26.6%)

- 5.5X growth in Education (15.4% → 85.2%)

- 100% AI Overview adoption in technical subcategories

- -8.7pp decline in eCommerce (only declining industry)

- <20% coverage for Finance & Restaurants

The Rollout Timeline

May 2024: Strategic Launch

- Healthcare leads at 67.6%

- B2B Tech at 34.2%

- eCommerce at 27.2%

- Focus on high-trust informational queries

September 2024: Public Rollout

- Education explodes (+42pp overnight)

- Insurance surges (+22pp)

- eCommerce drops to 8.8%

- Clear pivot to educational content

December 2024: Expansion

- Travel accelerates (8.1% → 36.9%)

- Healthcare reaches 84.2%

- Commercial queries remain suppressed

September 2025: Current State

- Education dominates at 85.2%

- Entertainment emerges at 45.9%

- eCommerce rebounds slightly to 18.5%

- Finance still minimal at 17.9%

The Intent Hierarchy

High Coverage (60-85%)

- "What is/How does" queries

- Medical definitions & symptoms

- Technical documentation

- Educational concepts

- Research comparisons (non-transactional)

Low Coverage (<20%)

- "Buy X online" queries

- Local commercial searches

- Financial advice

- Direct brand navigation

- Pure transactional intent

Takeaways from Data

- Google Protects Commercial Revenue eCommerce's decline from 27.2% to 18.5% reveals Google's strategy—AI Overviews appear where they add value without threatening ad revenue. Transactional queries remain in traditional SERP format.

- Specialized Knowledge Wins Subcategories with 100% adoption (CI/CD, Security Management, Ophthalmology) share three traits: high informational value, low commercial intent, and specialized expertise required.

- Industry Patterns Predict Opportunity Three clear patterns emerged:

- Early Adopters (Healthcare, B2B Tech): Started strong, steady growth

- Transformation Stories (Education, Insurance): Explosive growth after public rollout

- Late Bloomers (Entertainment, Travel): Minimal start, recent acceleration

- The September 2024 Inflection Public rollout triggered massive shifts—Education jumped 42pp overnight. This marks when Google found its sweet spot: high-value informational content with zero ad conflict.

Download the Full Report

Download the full report — complete industry data, rollout benchmarks, and insights to guide your AI Overview strategy.

Click the button above to download the full report in PDF format.

Published on September 11, 2025