Google AI Overview Holiday Shopping Test: The 57% Pullback That Changes Everything

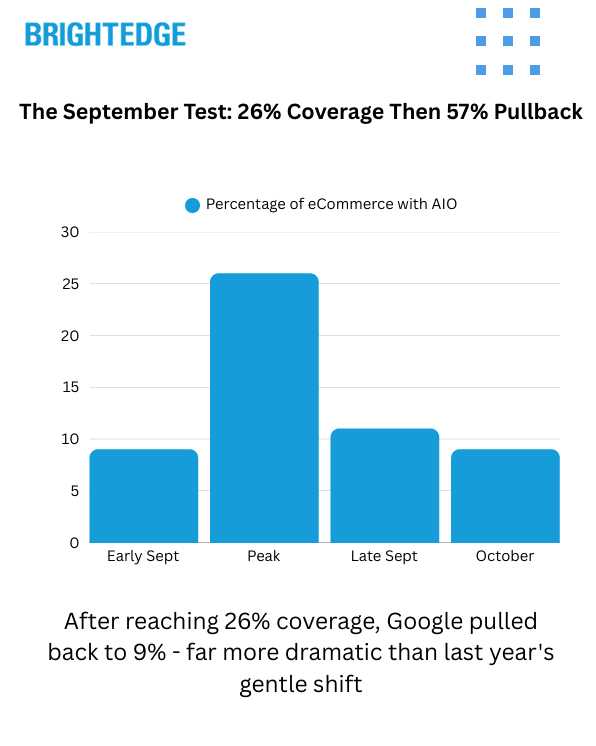

We tracked AI Overview across thousands of eCommerce keywords from September–October 2025. Coverage spiked from 9% to 26% on Sept 18, then pulled back to 9%—revealing Google’s holiday shopping strategy.

Data Collected: Analyzed AI Overview presence patterns across major ecommerce categories to understand:

- Daily percentage changes in AI Overview coverage

- Category-specific retention patterns

- Search volume correlation with AI Overview presence

- Year-over-year pattern changes

- Keyword intent and funnel stage analysis

Key Finding: Google retained only 30% of

AI Overviews at peak, with dramatic differences by category. Grocery maintained 56% retention while Furniture dropped to 3%—revealing a deliberate strategy to deploy AI where it adds value without disrupting commerce.

The September Spike Pattern

Coverage Timeline

- Sept 1-10: 9% baseline coverage

- Sept 11-18: Surged to 26% (peak on Sept 18)

- Sept 19-30: Rapid pullback to 11%

- Oct 1-15: Stabilized at 9%

The Magnitude Shift

- 2024: Gentle 5.6% reduction (321 → 303 keywords)

- 2025: Massive 56.8% reduction (741 → 320 keywords)

- 10x larger pullback year-over-year

The Category Hierarchy

Winners: High Retention Categories

Grocery & Food - 56% Retention

- Recipe queries maintained strong presence

- Ingredient information valued by AI

- Food preparation guidance prioritized

TV & Home Theater - 43% Retention

- Comparison content survived cuts

- "Best TV for [use case]" queries retained

- Technical specification explanations kept

Small Kitchen Appliances - 37% Retention

- "How to use" content preserved

- Product comparison queries maintained

- Feature explanation content retained

Losers: Low Retention Categories

Furniture - 3% Retention (97% removed)

- Visual shopping experience prioritized

- Traditional galleries preferred

- Limited informational value for AI

Home - 7% Retention (93% removed)

- Decorating queries removed

- Shopping-focused vertical

- Visual browsing emphasized

Apparel - 23% Retention (77% removed)

- Fashion requires visual discovery

- Size/fit better served by reviews

- Brand shopping preserved for traditional search

The Search Volume Revelation

2025's Complete Strategy Reversal

Unlike 2024, Google now retains higher-volume keywords:

- Retained keywords: 13,675 median search volume

- Removed keywords: 12,817 median search volume

- Ratio: 1.07x higher volume for retained

Volume Distribution

Removal rates were surprisingly uniform across volume quartiles:

- Q1 (Lowest): 71.5% removed

- Q2 (Med-Low): 73.1% removed

- Q3 (Med-High): 75.0% removed

- Q4 (Highest): 66.5% removed

The Intent Pattern

What Google Kept

Middle-Funnel Dominance

- 26.3% of retained keywords are evaluation/comparison queries

- "Best [product]" queries show 25% retention

- "X vs Y" comparisons maintained strong presence

Research & Learning

- "How to" queries retained where applicable

- Educational content about products preserved

- Comparison and evaluation prioritized

What Google Removed

Bottom-Funnel Purge

- Transactional keywords heavily removed

- Price-related queries eliminated

- Specific product names dropped

- "Buy" and "deals" queries removed

The Strategic Logic: AI Overviews help during research, step back during purchase

Holiday Predictions Based on Patterns

Expected November Behavior

If 2025 follows 2024's seasonal pattern:

- Current: 9% coverage

- November projection: 10-11% coverage

- Rationale: Research phase intensifies

Expected December Behavior

- December projection: 8-9% coverage

- Rationale: Purchase intent dominates

- Pattern: AI steps back for shopping season

The Opportunity Window

- November: Citation opportunities during research phase

- December: Traditional search dominates purchases

- Critical timing: Content must be ready NOW

Strategic Implementation Framework

For High-Retention Categories (>40%)

- Double down on comparison content

- Create comprehensive buying guides

- Build "best of" content for every segment

- Focus on educational material

For Medium-Retention Categories (20-40%)

- Test both AI and traditional optimization

- Monitor weekly for pattern changes

- Create topic clusters for stability

- Balance informational and transactional

For Low-Retention Categories (<20%)

- Prioritize traditional SEO tactics

- Focus on shopping feed optimization

- Invest in visual content

- Maintain product grid prominence

Universal Patterns Across Verticals

Despite category differences, certain patterns hold:

Content Types That Win

- Evaluation content ("best [product for use case]")

- Comparison content ("X vs Y")

- Educational content ("how to use")

- Higher search volume queries

Content Types That Lose

- Transactional queries

- Specific product searches

- Price-focused content

- Brand-specific queries

The 82% Reshuffling

Year-over-year keyword overlap: Only 18%

This massive reshuffling indicates:

- Google is actively experimenting

- Strategies must be flexible

- Historical performance doesn't guarantee future presence

- Monitoring is more critical than ever

Actionable Insights for SEO Professionals

Immediate Actions

- Audit your content: Identify evaluation vs transactional pages

- November priority: Get comparison content indexed NOW

- Category check: Assess your vertical's retention rate

- Volume analysis: Focus on 13K+ search volume keywords

Long-Term Strategy

- Dual approach: Win AI for research, traditional for transactions

- Content clusters: Build comprehensive topic coverage

- Monitor volatility: Weekly tracking through holidays

- Prepare for change: Only 18% YoY consistency

Technical Methodology

Data Sources:

- Daily AI Overview tracking Sept 1 - Oct 15

- Keyword-level analysis across ecommerce categories

- Search volume correlation analysis

- Category-specific retention calculations

Measurement Period: September 1 - October 15, 2024 and 2025

Analysis Tools: Manual tracking and proprietary monitoring systems

Key Takeaways

- The 57% Rule: Google pulled back 57% from peak, 10x more aggressive than 2024

- The Category Split: 56% retention (Grocery) vs 3% (Furniture) shows clear priorities

- The Volume Flip: Higher volume now retained (opposite of 2024)

- The Intent Filter: Research queries win, transactional queries lose

The 82% Shuffle: Only 18% keyword overlap year-over-year

Industry Implications:

This test reveals Google's dual strategy: Help users research with AI Overviews, preserve commercial intent for traditional results. The aggressive pullback suggests quality thresholds are higher than ever, while category-specific patterns show Google understands where AI adds vs. detracts from user experience.

For brands preparing for holiday shopping season, the message is clear: November is for research (AI Overviews), December is for buying (traditional search). Position your content accordingly.

Download the Full Report

Download the full AI Search Report — Google AI Overview Holiday Shopping Test: The 57% Pullback That Changes Everything

Click the button above to download the full report in PDF format.

Published on October 30, 2025