Fathom Leveraged Local Search to Research Ranking Differences

Read Fathom's set of guidelines and local-search best practices for colleges to consider as part of a comprehensive digital marketing strategy

Local Search for Colleges & Universities: What You Need to Know

1 Introduction

1.1 Experiment Objective

1.2 Experiment Scope

1.3 Experiment Subject

1.4 Experiment Hypotheses

2 Findings

2.1 Branded vs. Non-Branded

2.2 Stability vs. Volatility

2.3 Universal Search

3 Summary

3.1 Experiment Wrap-Up

3.2 Local Search Practical Applications

Introduction:

Experiment Objective:

The Fathom Education SEO team decided to conduct an experiment to leverage local search to understand ranking differences in various markets. Often educational institutions have difficulty understanding search-engine optimization at the national level, due in large part to the competitive nature of the digital education space. Instead of going up against 3-5 competitors, as is common in many industries, educational institutions and their marketers often contend with hundreds of competitors for each program offering. Understanding how rankings fluctuate from local market to local market would provide a clearer sightline into the educational marketing landscape and opportunities for optimization.

Experiment Scope:

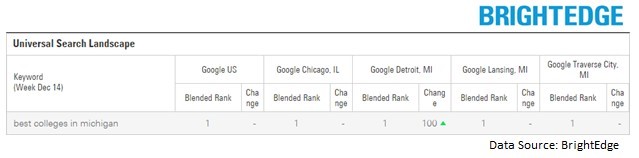

The team identified an ideal client and looked at its tracked keyword set to identify which keywords would be nominated for local-level tracking. Utilizing marketing leading technology from BrightEdge, they identified relevant Google local search engines: Google Chicago, Google Detroit, Google Lansing, and Google Traverse City (fig. 1.0). They then created custom dashboards to track and visualize keyword movement.

With the help of the customer success team at BrightEdge, data collection for this experiment occurred between September 2014 and December 2014. Only keywords which were ranked for each of the tracked weeks were included in the data set; if a keyword went unranked during one of the weeks, it was excluded.

Fig. 1.0 – Google Search Engines

Experiment Subject:

The subject of Fathom Education’s local search ranking research was Central Michigan University, a public institution in Mount Pleasant, Michigan, 150 miles northwest of Detroit. Offering over 200 academic programs, with an undergrad enrollment of 20,000+ students, Central Michigan University is one of the country’s 100 largest universities. It was ranked as the #194 national university by U.S. News & World Report in its most recent college edition.

Experiment Hypotheses:

Certain markets would emerge stronger than others, particularly in the search engines closest to campus. Non-branded terms would have larger ranking variances than branded terms.

Findings:

Branded vs. Non-Branded

The Fathom Education team initially grouped keywords into two segments: One bucket for branded keywords, and the other for non-branded keywords. This segmentation was important to test the hypothesis that branded keywords would be less prone to ranking shifts across the timeline of the project.

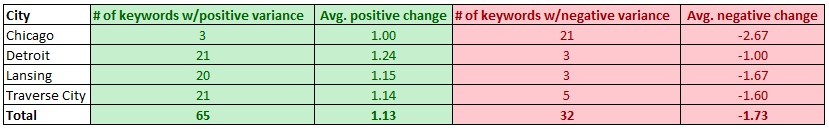

Central Michigan University’s branded keywords maintained similar rankings in the local search engines compared to the Google US baseline. On average, branded keywords in the local search engines remained within 1.43 positions of Google US rankings.

Detroit saw the largest positive branded ranking variance from Google US, and Chicago saw the largest negative variance (figure 1.01).

Figure 1.01 - Branded keyword ranking variance from Google US baseline

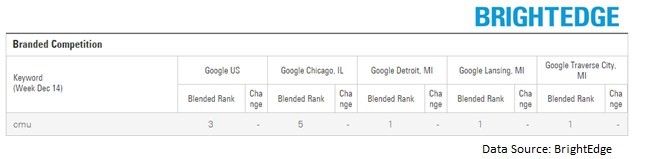

The most consistently variable branded keyword was the acronym CMU, where lower rankings were observed in local search engines due to competition from Carnegie Mellon University (https://www.cmu.edu/index.shtml) (fig. 1.02).

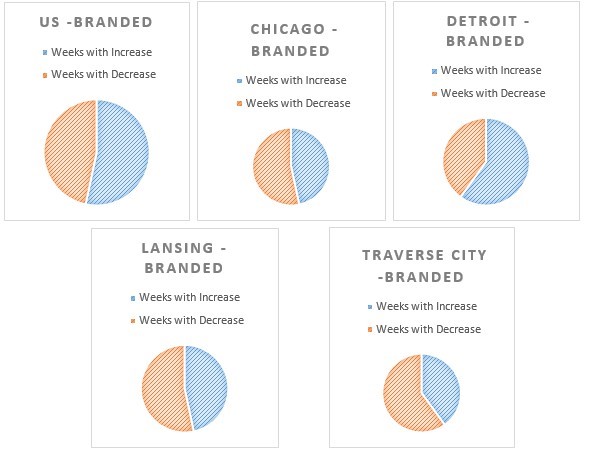

When examining branded keywords in each search engine across the timeline of data collection, Detroit saw the most weeks with ranking increases, while Traverse City had the most weeks with ranking decreases (fig. 1.03).

Figure 1.03 – Branded performance by week

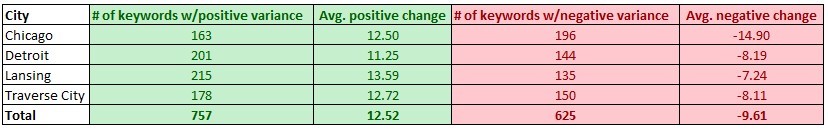

Much larger ranking variances were noted in the local search engines from the non-branded keyword segment. On average, non-branded keywords experienced an 11.06 position ranking difference from their Google US ranking baseline.

The Lansing search engine had the largest positive non-branded ranking variance from Google US, whereas Chicago had the largest negative ranking variance (figure 1.04).

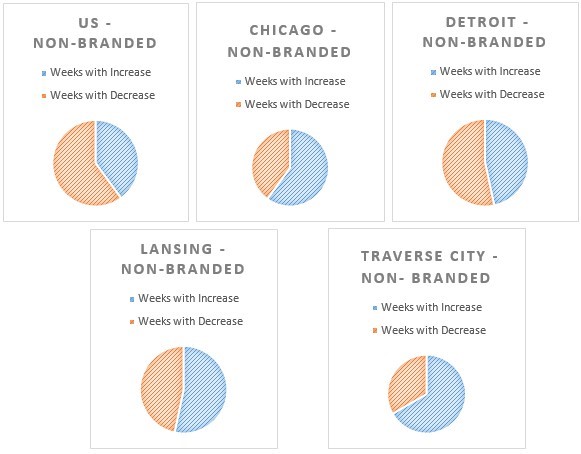

When compared to initial non-branded keyword rankings, Traverse City experienced the most weeks with ranking increases, and Google US experienced the most weeks with ranking decreases across the research timeline. (fig. 1.05).

Figure 1.05 – Non-branded performance by week

Stability vs. Volatility

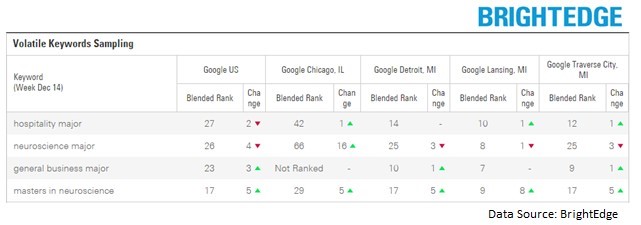

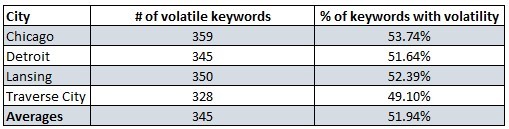

As the experiment continued, the team noticed ranking trends and created two additional keyword segments: stability and volatility. The stability segment was made up of branded and non-branded keywords with very little ranking variances; these words were predominately situated on the same search results page across the 5 tracked engines. The volatility segment was populated with non- branded keywords that had varied page rankings in the different search engines, or significant swings in rankings week over week (fig. 1.06).

Tracking these two segments was important in calculating what percentage of our focus keywords were “volatile.” In total, the following non-branded keyword volatility percentages were exhibited throughout the course of the experiment: Chicago – 53.74%, Detroit – 51.64%, Lansing – 52.39%, Traverse City – 49.10%. On average, 51.94% of tracked non-branded keywords were volatile (fig. 1.07).

Figure 1.07 – Volatile keyword percentages

Universal Search:

In addition to fluctuations in traditional search results, the team also recognized variations in universal search results. At times Central Michigan University had universal listings ranking in the first position in the local engines, then dropped into lower positions in subsequent weeks. This back-and-forth demonstrated shifts in Google’s algorithm and highlighted how search results can be affected (fig. 1.08, fig. 1.09).

(Central Michigan University gained 100 ranking positions in the Detroit search engine week-over-week with a “carousel” listing in the universal search results.)

Fig. 1.09 – Universal Search Carousel Listing

Summary

Experiment Wrap-Up:

Examining the data and findings, Fathom Education was able to confirm its hypotheses. In fact, non- branded keywords did display a higher risk of volatility than branded keywords, and the search engines closest to the physical campus typically resulted in higher rankings for these keywords than the Google U.S. results.

Expanding on these insights, Fathom developed a set of guidelines and local-search best practices for colleges to consider as part of a comprehensive digital marketing strategy.

Local Search Practical Application:

We recommend reviewing and implementing the following to improve your own institution’s local search presence

1. The first thing you’ll need in order to have a successful local search strategy is localized rank tracking. Without knowing your baseline ownership of the local search results, gauging improvements will be hard. We recommend BrightEdge for ease of functionality and the most in-depth reporting.

a. If you’re trying to settle on which keywords you need to invest in for local rank tracking, start by looking at your branded keywords. If your college has a strong brand presence and generally sees little branded competition, leaving branded tracking at the national level is probably ok.

b. Looking at Fathom Education findings for Central Michigan University, just over 50% of the tracked non-branded keywords were considered “volatile,” and displayed larger variances between the national and local engines. Knowing that, consider nominating 50% of your non-branded keywords as critically important to success, and start tracking them geographically.

c. Start near home. Recent ACT data suggest that the average student will travel less than 50 miles to attend college, with 78% of students remaining in-state for their education. Therefore, honing in on local search engines will help keep focus on the most potentially valuable sources of new students.

2. Next, you’ll want to define pertinent goals for local search. All local engines will not necessarily perform the same, and seeing wins across the board will be doubtful. So, setting realistic benchmarks is important to help you celebrate each individual feat. Whether an increase in traffic to a new program page, a boost in applications for the fall session, or more social shares for a premium video, knowing what you want to accomplish will help provide a clearer picture of your success.

a. Once those determinations have been made, set up goals and/or event tracking in Google Analytics and utilize annotations to mark important changes and achievements.

3. Cover your on-site foundation. Ensuring the following basic pieces are in place will give you the best chances of seeing success in the local engines:

a. Utilize geographic modifiers in the title tags of relevant pages. Including your city or state in your title tag will signal local relevance to both the search engines and the searchers. Doing the same in your meta descriptions will help click through rate on your organic listings.

b. Optimize your college’s ‘location’ pages. Beyond the title tag and meta description, include the following information on your location pages: schema location mark-up, embedded Google Maps, zip codes, distances from other regional cities, detailed directions, and local landmarks. All of these will provide semantic location details to the search engines and help increase your chances of achieving first-page rankings.

c. Utilize all your available content. Images, videos, and PDFs should be treated the same as other on-site content. Optimize them accordingly with alt attributes and meta- descriptions.

4. Be mindful of universal search. Beyond images and videos, think of the other types of results that are appearing in the search engines: Specifically for colleges, "carousel" and "places" listings. Optimize your Google Places presence by creating a page for each satellite or regional campus. Additionally, consider marking your upcoming events with schema code so the search engines will pull them directly into the results pages.

5. Understand your existing rankings and tailor content towards the locations where your institution is struggling the most. Consider developing a landing page or microsite where you can house localized content to help address the issue. Taking advantage of offsite advertising such as radio spots or billboards in areas of concern could also drive traffic to a website and increase engagement.

6. Build credibility with local institutions. Is your city known for its hospitals? Or maybe its theater district? Form relationships with these organizations to signal strength in the eyes of the local search engines. Earning a relevant link from credible sources to your program pages or promotional content will result in more traffic to your site, as well as boosted ranking potential.

7. Let paid search be your friend. While paid search does not represent the answer to organic local search needs, creating a unified approach to digital marketing can assist in achieving goals.

a. Support struggling organic rankings with increased bids in paid search campaigns. While waiting for the effects of SEO, searchers in your underperforming locations will be able to see your content in the top slots of the results pages.

b. By contrast, current leaders in organic search who consider increased domination of the search results page with enhanced paid bids could help combat pressure from both existing and up-and-coming competitors.

8. Build awareness outside your core market. As we saw throughout the analysis, there’s a greater likelihood of variability in rank position in local markets outside of that which the university is actually located. Search engines take into account the importance of content to users in a specific locale – therefore localized citations (i.e. brand mentions and links) originating from sites with a footprint associated closely to a location can influence your rankings across markets.

a. For example, consider that CMU saw a higher negative variation in rank in the Chicago market vs. Google US. In order to increase relevance for the targeted terms in the localized Chicago search results, we might suggest utilizing existing partnerships or marketing initiatives to gain additional citations in that market. One such practical example might be to launch additional press around a booth at a college fair in Illinois. Or, if CMU is partnering with a hospital in the Chicago area on cutting-edge medical research you can take that as an opportunity to generate powerful localized citations.

*During the duration of this project, some, but not all pages of the subject site were edited. The Fathom team tracked a variety of non- optimized keywords to limit the effects of site modifications on the experiment. Looking at the trend of the results instead of one metric or data set provides a clearer perspective on the landscape.