Finance AI Citations: How ChatGPT and Google Define Trust Differently

As we continue our analysis of critical YMYL categories, this week we're examining Finance. When AI answers questions about money, investments, and taxes, accuracy directly impacts users' financial decisions. So who does each platform actually trust?

Data Collected

Using BrightEdge AI Catalyst™, we analyzed finance citations across ChatGPT, Google AI Mode, and Google AI Overviews to understand:

- Which source types each platform cites for finance queries

- How citation patterns differ by query type (stock lookups, tax questions, retirement planning, educational queries)

- Platform stability and volatility in finance citations

- Where Google is experimenting with new content formats like video

Key Finding

Unlike healthcare — where we saw a two-way split between ChatGPT and Google — finance reveals three completely different trust philosophies. ChatGPT trusts financial data aggregators (70%+). Google AI Mode trusts trading platforms (40% — 7x higher than ChatGPT). Google AI Overviews trusts consumer education and video (34% video citations vs. 0% for ChatGPT). Same YMYL category, three fundamentally different approaches to authority.

The Trust Gap: Three Platforms, Three Philosophies

ChatGPT Trusts the Data. AI Mode Trusts Where You Trade. AI Overviews Trusts Where You Learn.

When we analyzed where finance citations actually come from, the platforms diverged sharply:

Financial Data/News: ChatGPT leads at 70%, followed by AI Mode at 51% and AI Overviews at 44%.

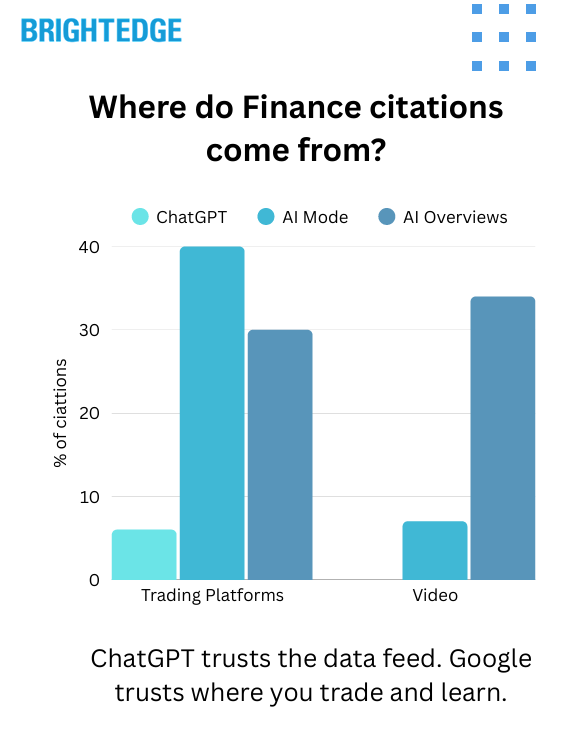

Trading Platforms: AI Mode dominates at 40%, with AI Overviews at 30% and ChatGPT far behind at just 6%. Trading platforms appear 7x more often in AI Mode than in ChatGPT.

Consumer Finance Education: AI Overviews leads dramatically at 96% combined share, compared to AI Mode at 42% and ChatGPT at 24%.

Video Content: AI Overviews cites video at 34% — the #2 source category. AI Mode shows 7%. ChatGPT cites zero video for finance queries.

Government (.gov): All three platforms show similar trust levels — ChatGPT at 11%, AI Mode at 12.5%, and AI Overviews at 17%.

ChatGPT leans heavily on financial data aggregators and market news — the platforms that provide real-time stock data, market analysis, and financial journalism.

Google AI Mode goes all-in on trading platforms — the brokerages and investment apps where people actually execute trades.

Google AI Overviews favors consumer finance education and video content — the explainers and educational resources.

The One Thing They Agree On

Government sources (.gov) are trusted at similar rates across all three platforms (11-17%). Regulatory and official sources like IRS, SEC, and FINRA form a baseline of trust. Everything above that baseline diverges dramatically.

Why the Difference? The Interface Explains the Trust Model

This three-way split actually makes sense when you consider the user experience:

AI Overviews still sits atop traditional search results. Users are in browse-and-learn mode — they expect to click through to educational content and watch video explainers. The trust signals reflect that intent.

ChatGPT and AI Mode are chat interfaces where users want direct, data-backed answers. ChatGPT leans toward authoritative data feeds. AI Mode — still within Google's ecosystem — bridges toward transactional sources where users might take action.

The interface drives the trust model.

Query Type Matters: Different Questions, Different Sources

Stock Lookups: Everyone Agrees

When users ask for stock prices or ticker information, all three platforms converge on financial data/news sources — but ChatGPT concentrates trust more heavily:

ChatGPT: 72% from financial data/news, less than 1% from trading platforms.

AI Mode: 50% from financial data/news, 8% from trading platforms.

AI Overviews: 47% from financial data/news, 4% from trading platforms.

ChatGPT trusts fewer sources more deeply for stock data. Google spreads trust wider, giving trading platforms a meaningful share.

Tax Queries: ChatGPT Trusts Government 2x More

For tax-related questions, ChatGPT shows the strongest preference for government sources:

ChatGPT: 50% government, 14% consumer education.

AI Mode: 37% government, 10% consumer education.

AI Overviews: 26% government, 14% consumer education.

ChatGPT is twice as likely to cite IRS and other government sources for tax queries compared to AI Overviews.

Retirement Planning: Same Pattern

For retirement and 401(k) queries, ChatGPT again leads with government sources:

ChatGPT: 39% government, 18% trading platforms, 24% consumer education.

AI Mode: 32% government, 19% trading platforms, 9% consumer education.

AI Overviews: 17% government, 16% trading platforms, 15% consumer education.

ChatGPT takes a government-first approach. Google's products split between government sources AND the platforms where you'd actually open a retirement account.

Educational "How-To" Queries: The Big Divergence

For educational finance queries, the platforms diverge most dramatically:

ChatGPT: 40% consumer education, 0% video, 13% government.

AI Mode: 15% consumer education, 0% video, 12% government.

AI Overviews: 14% consumer education, 9% video, 7% government.

ChatGPT trusts established consumer education publishers. AI Overviews pulls video into financial education queries — a content format ChatGPT isn't touching at all.

Trading/Investment Concepts: AI Overviews Bets on Video

For queries about options, ETFs, dividends, and other investment concepts:

ChatGPT: 23% consumer education, 0% video, 31% financial data/news.

AI Mode: 16% consumer education, 0% video, 15% financial data/news.

AI Overviews: 17% consumer education, 11% video, 12% financial data/news.

AI Overviews is betting that video can explain complex trading concepts. ChatGPT cites zero video for these queries.

The Pattern

For data queries (stock lookups): Everyone agrees — financial news wins.

For sensitive YMYL queries (tax, retirement): ChatGPT trusts government 2x more than AI Overviews.

For educational queries: ChatGPT trusts publishers; AI Overviews trusts video.

Query intent drives trust signals within each platform.

The Volatility Factor: Stability vs. Experimentation

ChatGPT Has Conviction. Google Is Testing.

Beyond source preferences, the platforms differ dramatically in stability:

ChatGPT: 65% average citation volatility (most stable).

AI Mode: 75% average citation volatility.

AI Overviews: 95% average citation volatility (most volatile).

Google's finance citations — especially in AI Overviews — are significantly more volatile than ChatGPT's. What you see in Google AI results today may shift. ChatGPT's citations have remained more stable over our tracking period.

What This Means

ChatGPT appears to have made decisions about finance authority and is sticking with them. Google is still actively experimenting — testing different source mixes, adjusting weights, and iterating on what works. AI Overviews shows the most experimentation, which aligns with its role as a newer feature sitting atop traditional search.

Google's Video Experiment in Finance

The Video Gap Is Massive

ChatGPT: 0% video citations.

AI Mode: 7% video citations.

AI Overviews: 34% video citations.

Google AI Overviews cites video as its #2 source category for finance queries. ChatGPT cites none. This is the most dramatic divergence between the platforms.

Which Query Types Trigger Video?

When Google does cite video for finance, it's concentrated in certain query types:

Trading/Investment Concepts: 11% video in AI Overviews.

How-To/Educational: 9% video.

Retirement Planning: 5% video.

Stock Lookups: 4% video.

Tax Related: Less than 1% video.

Video shows up most on conceptual and educational queries — not tax or stock data. Google appears to be testing where video adds value, starting with explanatory content before expanding to more sensitive YMYL queries.

What This Means for Financial Services Marketers

Track Citations Across All Three Platforms: ChatGPT, AI Mode, and AI Overviews have fundamentally different trust signals. You may be winning citations in one platform and invisible in the others. Measure all three.

Query Intent Matters: Stock lookups, tax questions, and retirement queries all pull from different source mixes. Understand which query types your content targets — and who gets cited for each.

Know Your Source Advantage:

- Financial data aggregators have an edge on ChatGPT

- Trading platforms have an edge on AI Mode

- Consumer education sites have an edge on AI Overviews

- Video content has an edge on AI Overviews (and no presence on ChatGPT)

- Government sources are trusted across all three — the baseline

Google Is Still Testing — ChatGPT Has Decided: Google's higher volatility means your visibility there may shift. ChatGPT is more stable — what you see now is likely what you'll get. Plan accordingly.

Video Is a Major Opportunity (On Google): If you're considering video for finance content, know that AI Overviews is already citing video heavily (34%). But ChatGPT isn't touching it. Your video strategy is a Google play, not a ChatGPT play — at least for now.

Technical Methodology

Data Source: BrightEdge AI Catalyst™

Analysis Approach:

- Finance URL-prompt pairs analyzed across three platforms: ChatGPT, Google AI Mode, Google AI Overviews

- Source categorization by type: Financial Data/News, Trading Platforms, Consumer Finance Education, Government (.gov), Video, Social/Community, Reference, and others

- Query intent categorization: Stock Lookup (Ticker), Stock Lookup (Company), How-To/Educational, Tax Related, Retirement Planning, Trading/Investment Concepts, Credit/Banking, Market Data

- Volatility measured using average percentage changes across citation sources

Data Volume:

- ChatGPT: 11,000+ URL-prompt pairs

- Google AI Mode: 35,000+ URL-prompt pairs

- Google AI Overviews: 30,000+ URL-prompt pairs

Key Takeaways

Three Different Trust Philosophies: ChatGPT trusts financial data aggregators (70%+). AI Mode trusts trading platforms (40% — 7x higher than ChatGPT). AI Overviews trusts consumer education and video (34%). Not a two-way split — a three-way divergence.

Query Intent Drives Trust Signals: Stock lookups converge on financial news. Tax and retirement queries show ChatGPT trusting government 2x more than AI Overviews. Educational queries show AI Overviews pulling in video while ChatGPT trusts publishers.

The Video Gap Is Massive: AI Overviews cites video at 34% (the #2 category). ChatGPT cites 0%. Video is a Google play, not a ChatGPT play.

Government Is the Baseline: All three platforms trust .gov sources at similar rates (11-17%). That's the floor. Everything above it diverges.

ChatGPT Is More Stable: Google's finance citations show higher volatility (75-95%) vs. ChatGPT (65%). Google is experimenting; ChatGPT has conviction.

The Interface Explains the Trust Model: AI Overviews sits atop search results where users browse and learn. Chat interfaces serve users who want direct, data-backed answers. The UX drives the source mix.

Download the Full Report

Download the full AI Search Report — Finance AI Citations: How ChatGPT and Google Define Trust Differently

Click the button above to download the full report in PDF format.

Published on January 15, 2025