AI Overview Citations Now 54% from Organic Rankings

16-month study reveals AI Overview citations increasingly overlap with organic rankings, growing from 32% to 54%. See industry breakdowns and strategy tips.

Data Collected: Monitored AI Overview citation overlap with organic rankings across 9 industries from May 2024-September 2025 using BrightEdge Generative Parser™ to analyze:

- Citation source patterns

- Overlap progression over time

- Industry-specific convergence rates

- Algorithm evolution phases

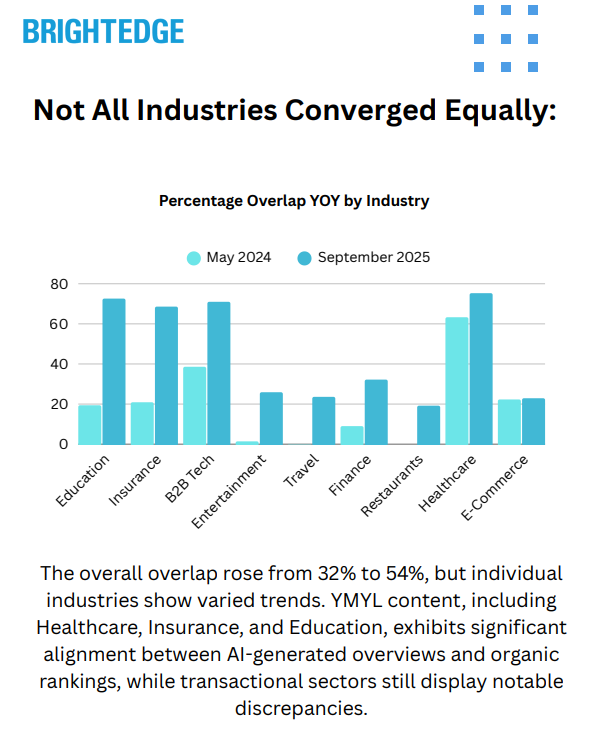

Key Finding: AI Overview citations increasingly come from pages that rank organically—overlap grew from 32.3% to 54.5% (+22.3 pp), but individual industries vary wildly from E-commerce's flat 0.6 pp change to Education's massive 53.2 pp surge.

The Big Numbers

- 54.5% of AI Overview citations now rank organically (up from 32.3%)

- 69% relative increase in overlap over 16 months

- 53.2 pp increase for Education (largest industry shift)

- 0.6 pp increase for E-commerce (only flat industry)

- 75%+ overlap for Healthcare and Education (highest convergence)

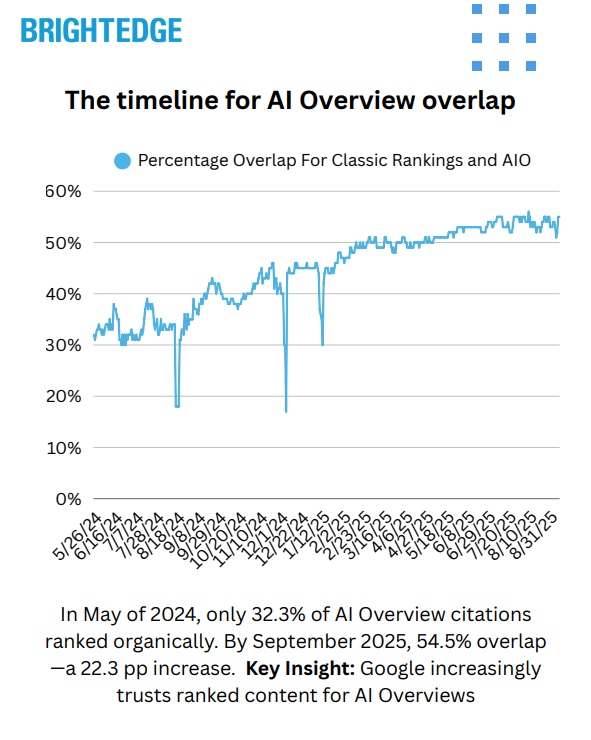

The Convergence Timeline

May 2024: Launch Baseline

- Overall overlap: 32.3%

- Healthcare leads at 63.3%

- Travel/Entertainment/Restaurants near 0%

- Most citations from non-ranking sources

September 2024: Public Rollout Catalyst

- Overlap jumps to 39.1%

- Acceleration begins (+5.4 pp in 2 months)

- Education and Insurance surge

- Clear shift toward ranked content

January 2025: New Year Acceleration

- Overlap reaches 45.2%

- Fastest growth period (~3 pp/month)

- Most industries showing convergence

- E-commerce remains flat

September 2025: Current State

- Overlap stabilizes at 54.5%

- Healthcare at 75.3%

- Education at 72.6%

- E-commerce still at 22.9%

- Pattern appears to be stabilizing

Industry Breakdown

High Convergence (68-75% overlap)

- Healthcare: 75.3% (started high, modest gains)

- Education: 72.6% (explosive +53.2 pp growth)

- B2B Tech: 71.0% (strong +32.4 pp growth)

- Insurance: 68.6% (major +47.7 pp surge)

Low Convergence (<33% overlap)

- Finance: 32.2% (steady but below average)

- Entertainment: 25.9% (late starter, catching up)

- Travel: 23.6% (started near zero)

- E-commerce: 22.9% (anomaly - virtually no change)

- Restaurants: 19.2% (started at zero)

The Three Phases

Phase 1: Testing (May-Aug 2024)

- Flat at ~32-34% overlap

- Google experimenting with sources

- Some industries had AIOs disabled

- No clear pattern emerging

Phase 2: Acceleration (Sep 2024-Jan 2025)

- 34.6% → 45.2% (+10.6 pp in 4 months)

- September public rollout triggers shift

- Fastest growth: ~3 pp per month

- Clear move toward ranked content

Phase 3: Convergence (Feb-Sep 2025)

- 45.2% → 54.5% (+9.3 pp)

- Crossed 50% threshold in May 2025

- Growth slowing, pattern stabilizing

Takeaways from Data

- The Convergence is Real but Uneven While overall overlap grew 22.3 pp, individual industries range from 0.6 pp (E-commerce) to 53.2 pp (Education). Your strategy depends entirely on your vertical.

- YMYL Content Drives Convergence Healthcare, Insurance, and Education show 68-75% overlap—when trust matters, Google strongly prefers content that already ranks well organically.

- E-commerce is the Exception The only industry where overlap stayed flat (0.6 pp) and AIO coverage actually decreased (-7.6 pp). Google appears to intentionally keep transactional queries separate from AI Overviews.

- Position 21-100 is the Sweet Spot Most overlap growth comes from pages ranking 21-100, not top 10. Only 16.7% of citations come from top 10 results, suggesting Google seeks diversity within ranked content.

- September 2024 Changed Everything The public rollout marked a clear inflection point—overlap jumped 5.4 pp in two months. This is when Google committed to favoring ranked content for AI Overviews.

Download the Full Report

Download the full AI Search Report — 16-month study reveals AI Overview citations increasingly overlap with organic rankings, growing from 32% to 54%. See industry breakdowns and strategy tips.

Click the button above to download the full report in PDF format.

Published on September 18, 2025