Google announced its Page Experience update in 2020, and officially rolled it out between June and September of 2021. The update was aimed at improving web page interactions for visitors. To put this in practical terms and give web developers targets for improvement, Google established Core Web Vitals to measure three key elements of the page experience: loading performance, interactivity and visual stability of the page. Today, Core Web Vitals are a confirmed ranking factor for organic search results.

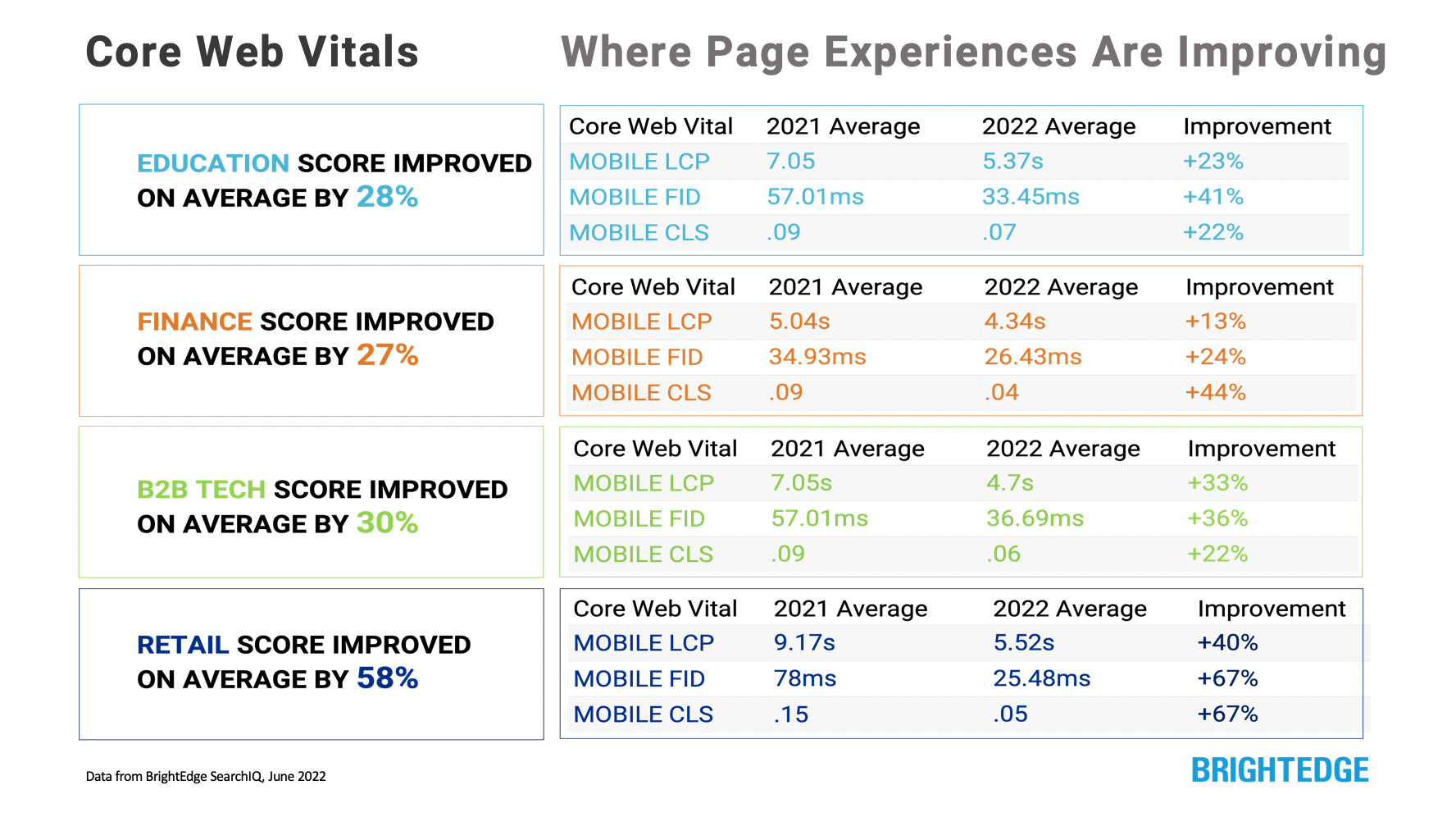

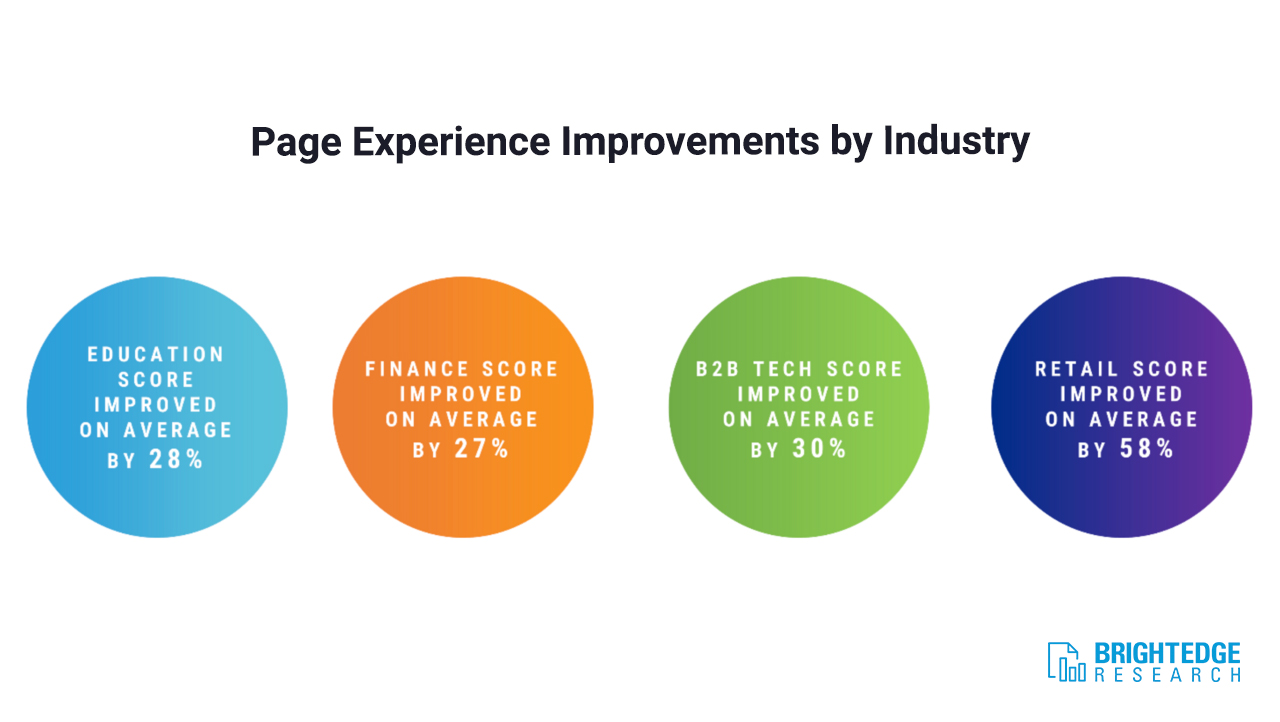

While many times we need to essentially trust that a particular Google update is improving the search experience for our users, the empirical nature of Core Web Vital (CWV) metrics makes it possible for individual websites and brands to measure the impact of CWV-oriented site improvements. BrightEdge has taken that a step further and measured the impact of CWV for four distinct markets: Education, Finance, B2B Tech, and Retail. The impact of Core Web Vitals has been significant in these markets.

What are Core Web Vitals?

Google defines the purpose of and metrics for Core Web Vitals as:

“The page provides a good user experience, focusing on the aspects of loading, interactivity, and visual stability:

- Largest Contentful Paint (LCP): Measures loading performance. To provide a good user experience, strive to have LCP occur within the first 2.5 seconds of the page starting to load.

- First Input Delay (FID): Measures interactivity. To provide good user experience, strive to have an FID of less than 100 milliseconds.

- Cumulative Layout Shift (CLS): Measures visual stability. To provide a good user experience, strive to have a CLS score of less than 0.1.”

Beyond improving a page’s prospects for a higher search ranking, improving CWV also affects key business measures such as conversion and brand loyalty.

- Reducing loading time (Largest Contentful Paint) reduces user bounce rates and can improve conversion rates by as much as 15%

- Improving interactivity (First Input Delay) helps a site respond more quickly to a user’s actions on the page. Better interactivity reduces bounce rate and helps ensure a user is more likely to return to the site.

- Improving visual stability (Cumulative Layout Shift) delivers a smooth, engaging experience. Shifting page elements are disruptive and detrimental to conversion.

The Needle Has Moved on Core Web Vitals

Leading up to the rollout of the Page Experience Update, we wanted to assess the top-ranking URLs' Core Web Vitals for the most popular search terms in four industries: Education, Finance, B2B Tech, and Retail. To do this, we identified 500 keywords in each industry and used BrightEdge's patented Share of Voice technology to identify URLs that were ranking the most. We measured mobile rankings because, with Google’s mobile-first indexing, mobile traffic is the primary source of visitors for most websites. When we ran this analysis, we found very few of the URLs were meeting what Google considers a good experience. Now with nine months of real-world data for comparison we can see whether and how the focus on Core Web Vitals has changed the user experience. Here’s what the analysis shows:

Improvement Across the Board

Across all four industries, we measured improvement in aggregate CWV scores. While this means that, on average, sites classified under each industry banner have seen improvement it does not mean all sites in the industry have improved. In fact, some of the winners have shifted with domains that held high share-of-voice before Core Web Vitals falling in prominence and other previously less prominent sites gaining share-of-voice.

When we look closer at each CWV metric for each industry, remarkably, again we find universal improvement.

Education

The results are based on measurement of 205 unique URLs ranking for top education keywords. In addition to the aggregate findings, we observed some changes the domains capturing top ranks including more .gov sites and the emergence of domains like Higherdjobs.com and Netflix that were not previously ranking for the keywords.

Finance

Within Finance, mortgage brokers saw the most gains this year among the 312 unique finance URLs that ranked for top finance keywords. Conversely, bank sites saw the fewest gains year-over-year (YoY). The finance sector saw the lowest differential in performance gains (YoY) compared to the other three markets we assessed, but it started with the highest performing Core Web Vitals.

B2B Tech

For the B2B Tech market we looked at 258 unique URLs. Prior to the rollout of CWV, we saw links from app stores occupying significant share of voice for productivity tools. This year, those seem

to be won by publishers and resources from SaaS platforms. Pages on the domains with the biggest increased presence in search, like TechTarget.com, appear to load faster and have shorter delays on average.

Retail

When we first measured retail keywords, one of the issues we saw broadly was the use of scripts that caused Cumulative Layout Shift issues. This year, the vast majority of the scripts we found previously no longer seem to be in use. This kind of sea change in site technology is a great example of the impact CWV is having on websites. Among the 459 unique retail URLs we looked at we saw a reduction in the presence of review pages and an increase in the presence of retail pages from sites like Amazon.com

Key Takeaways

Judging by these findings, it is safe to say that using the web is better today than it was a year ago. The results are certainly encouraging and represent the combined impact of the work marketers performed to improve their sites in response to the rollout and the effects of the Page Experience Update and how it factors into choosing which pages win higher ranks. It does not mean there is not more work to be done, however. Even despite the gains, in some instances the scores fall short of what Google deems “good” performance. For example, the average Largest Contentful Paint score of 5.52ms for retail sites represents a 40% improvement over last year’s measurement but is still below Google’s target performance.

Perhaps more importantly, the highest performing sites today are outperforming the best sites from nine months ago. Because we have seen shifts among the leading domains in search results, brands need to be vigilant about monitoring Core Web Vitals performance and working toward continual incremental improvement.